A normal user is going to run a light node or use a web wallet. In the context of sharding - why would random users run a node for some random shard they don’t particularly care about?

True, but the point isn’t so much to get every user to run a full node, but to keep the cost of full nodes down to the level that a dedicated person or team and set up their own node network and copy the state of the system without too much difficulty.

Take for instance, a blockchain with, say, 21 supernodes that are so huge they cost millions of dollars to setup. Under this system, forking the chain not only requires downloading the entire state from one of these supernodes (who might be colluding to prevent such things) but also large upfront capital. This gives the supernodes much more power then even a mining pool with >>51% hashrate.

That said, I think you’re idea of increasing the gas limit by 10x is interesting. After such an increase, it would still be possible to run a node at reasonable cost, (<$10,000) but it would be out of reach of most people with everyday hardware. I don’t know of any examples of such ‘inbetweener’ blockchains systems.

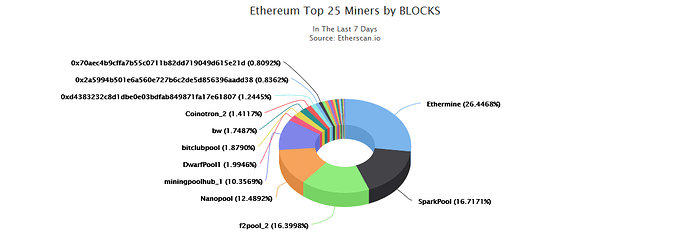

The problem is, people who are not pool operators are not incentivised to run a full node, and unfortunately, mining pools are so few in numbers 21 dedicated DPoS nodes would probably even be more then all mining pools with non-negligible hashrate.

If there was some way to make it so the cost for setting up a node could be medium, (~$10,000) and that there would be a few thousand of them, you could still have forks and a much lower chance of collusion, while making the chain (at least the base layer) much more usable. You would need someone other then pool operators to be incentivised to run a full node though. Instead of right now, where running full nodes is mostly done on altruism.

It’s hard to quantify, but globally probably >100x more resources went into optimizing ethash computation (including asic design) rather than making nodes and network propagation faster. That’s not a good allocation of resources.

Agree. Although, this seems more like an argument for Proof of State then increasing the gas limit.