Hegic is an on-chain options trading protocol on Ethereum powered by hedge contracts and liquidity pools. Protocol can be used for trustless creating, maintaining and settling of hedge contracts.

Whitepaper: https://ipfs.io/ipfs/QmWy8x6vEunH4gD2gWT4Bt4bBwWX2KAEUov46tCLvMRcME

Hedge contract is an options-like on-chain contract that gives the holder (buyer) a right to buy or to sell an asset at a certain price (strike) as well as imposes the obligation on the writer (seller) to buy or to sell an asset during a certain period. Hedge contracts can be considered as a non-custodial, trustless and censorship-resistant alternative to options contracts. Exercising of hedge contracts is guaranteed by the liquidity allocated and locked on them, timestamps and Ethereum Virtual Machine (EVM) that executes the code.

On Hegic, liquidity providers’ (writers’) funds can be distributed between many hedge contracts simultaneously. It diversifies the liquidity allocation and makes capital work in an efficient way. The assumption is that in the long-run, liquidity providers’ returns could beat the returns of a solo options writer.

The initial implementations of Hegic will enable holders to buy put hedge contracts that will give them a right to swap ETH to DAI stablecoin at a certain price (strike) at any given moment until the expiration. Hegic uses a dynamic strike price determination approach, which influences the rate and the premium of hedge contracts. Maintenance and execution of hedge contracts do not depend on the external price feeds.

Liquidity pools are non-custodial. In the initial implementations of Hegic, the rate for holding a hedge contract varies from 0.5% up to 2.0% per week. Theoretical yearly returns for hedge contracts writers (sellers) are in between from +27% up to +108% APR on DAI, USDC or USDT. While allocating DAI token in the pool on Hegic, liquidity providers will be simultaneously earning DSR (DAI Savings Rate) with the help of CHAI (ERC20 wrapper over the DSR). Allocating DAI in the liquidity pool provides writers with the returns on DAI paid by MakerDAO’s DSR plus the premiums that are paid by hedge contracts holders.

HEGIC an ERC20 token that is used for distribution of 100% of the settlement fees between all the token holders and in the protocol on-chain governance purposes. HEGIC token combines the collective fractional ownership, utility and governance functions.HEGIC has a fixed supply of 3012009 HEGIC tokens, which will be unlocked with the time after the particular goals are reached by the Hegic protocol.

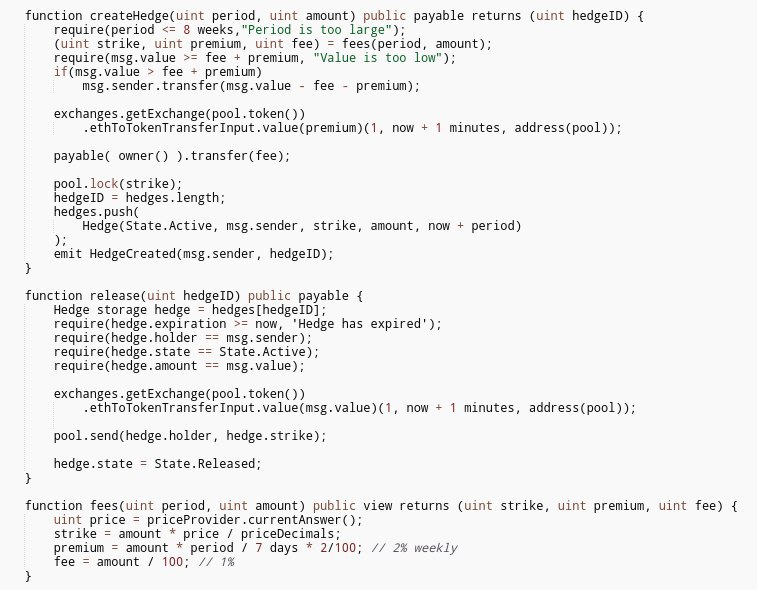

Code of the deployed ETH put hedge contract:

Hegic protocol is live on Ethereum mainnet: https://www.hegic.co

Open source code of the Hegic protocol: /hegic on Github

Hegic ETH Put Hedge Contract (Ethereum mainnet): 0x27b6125328ca57d5d96baaa4f9ca8c5edbafe016

Hegic DAI Liquidity Pool Contract (Ethereum mainnet): 0x009c216b7e86e5c38af14fcd8c07aab3a2e7888e

Feedback is very much appreciated.