TL;DR

Backround

In the early days of banking, the pitch or narrative presented to customers focused on a few key benefits:

-

Safety and Security: Banks and early banking institutions like temples or palaces offered a secure place to store valuable commodities, such as grain, precious metals, and other goods. This was particularly important in ancient times when theft and insecurity were common.

-

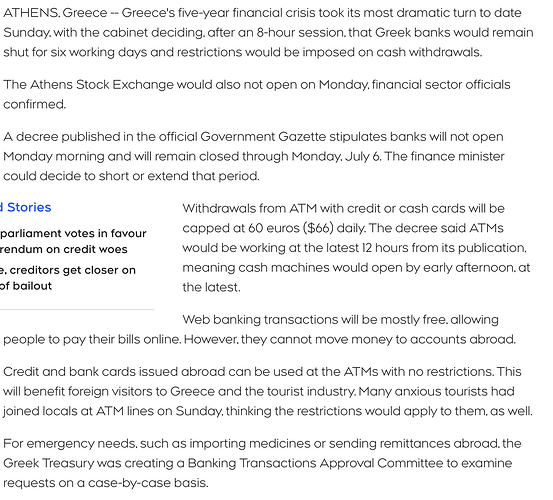

Convenience: Banking institutions provided a convenient way to manage financial transactions. Instead of carrying large amounts of money or goods, individuals could deposit their wealth and make transactions through the bank, simplifying trade and commerce.

-

Facilitation of Trade: By acting as intermediaries, banks facilitated trade by providing loans and credit. This allowed merchants to finance their operations, expand their businesses, and engage in long-distance trade more effectively.

-

Record Keeping: Banks maintained detailed records of deposits, loans, and other transactions. This provided individuals and businesses with a reliable way to keep track of their financial activities and plan for the future.

-

Financial Services: Banks offered various financial services, such as currency exchange, loans, and credit. This enabled individuals and businesses to access funds when needed and manage their finances more effectively.

-

Interest and Returns: Early banks often offered interest on deposits, providing an incentive for people to deposit their money rather than keeping it idle. This also allowed banks to use deposited

funds for lending and investment, generating returns for both the bank and the depositor. -

Stability and Trust: Over time, reputable banking institutions established a sense of stability and trust. Customers were reassured by the bank’s reliability and the formalized processes they offered, which were often backed by influential entities like governments or wealthy families.

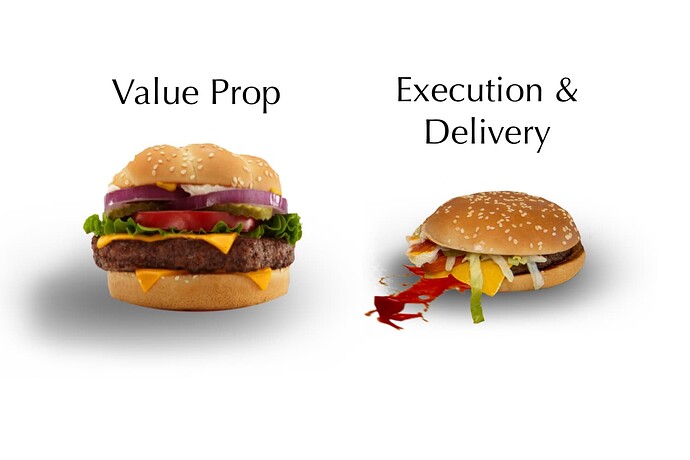

The narrative was centered around the idea that banks provided a safe, convenient(See "Athens Greece News Post below), and efficient way to manage and grow wealth (whose wealth?), thereby supporting both individual and commercial financial needs.

That was the Value prop…

----------------------------------------------------------------------------------------------------------->

------------------------------------------------------------------->

While blockchain technologies advocate for decentralization in terms of architecture and governance, the mechanisms for funding and development can sometimes exhibit centralized characteristics. Here are a few reasons for this and some implications

------------------------------------------------------------------->

Banks aren’t the problem. A bank is just a building. Greed is the problem. It creates a barrier for entry, and an even bigger barrier for innovation to thrive how it should, without sacrificing ideologies just to get funding and then being stuck between getting the funds by joining the “Old Boys Club” or sticking to your moral grounds and ideals but not being able to do anything with it.

Stifling innovation and replacing it with what have now become nothing but mere catch phrases. “Decentralization” doesn’t matter on its own. It’s just the potential pathway to get what we really need from all this:

- Equality

- Freedom of choice and speech

- Self Sovereignty

- Trust inherently

Why Care About Decentralization?:

Decentralization isn’t just about rejecting centralized control for its own sake. Instead, it addresses several critical societal and operational concerns:

-

Empowerment and Equity: Decentralization shifts the power from a centralized authority to multiple stakeholders, enabling a fairer distribution of power. This shift promotes equity, allowing individuals and smaller entities more influence over decisions that affect their lives and operations.

-

Community and Stakeholder Engagement: By involving more participants in the decision-making process, decentralization enhances community engagement. This involvement can lead to decisions that better reflect the diverse interests and needs of the broader community.

-

Transparency and Accountability: Decentralized systems often require mechanisms that make operations more transparent and participants more accountable. This openness can reduce corruption and increase trust among stakeholders.

-

Innovation and Diversity of Thought: Decentralization encourages a wider range of ideas and solutions, fostering innovation. In a decentralized system, individuals and teams have the freedom to experiment and implement diverse solutions, which can lead to more creative and effective outcomes.

-

Resilience Against Failures and Attacks: A decentralized structure is less prone to systemic failures and cyber attacks. Since there’s no central point of failure, challenges or breaches in one area do not cripple the entire system, making it more robust and reliable.

In summary, when we discuss why we care about decentralization, we’re focusing on building systems that are equitable, inclusive, and designed to serve the broader interests of all stakeholders & users involved, rather than just enhancing the profitability of a few. This approach not only strengthens the system’s ethical foundation but also its operational efficacy and societal impact.

Cause for Concern at the Root (Pain Points for Startups):

Centralization in Grant Distribution

-

Resource Allocation: Even in decentralized networks, there’s often a need to manage resources, including capital, in a way that ensures the ecosystem grows healthily. Foundations often steward these resources because they have the infrastructure to manage and distribute funds effectively.

-

Quality Control: By funneling grants through foundations or similar bodies, the ecosystem can maintain a certain level of quality and coherence in development. This helps prevent fragmentation and ensures that projects align with the overall strategic goals of the blockchain.

-

Initial Stages of Ecosystem Development: In the early phases of any blockchain ecosystem, more centralized control can help steer the project towards stability and maturity. As the ecosystem matures, mechanisms can be implemented to decentralize decision-making processes, including funding.

Implications

-

Gatekeeping: Centralized funding can lead to gatekeeping, where only projects that align with the specific visions of the grant-giving bodies are funded. This can stifle innovation outside of those parameters.

-

Influence Over Development: Foundations or core teams can significantly influence the direction of the blockchain’s development through funding decisions. This can potentially conflict with the decentralized ethos of blockchain technology.

-

Dependency: Relying on central bodies for funding might create dependency, which could be problematic if the goals of the central body change or if it faces financial difficulties.

VC Funding

Venture capitalists often look for proof of partnerships with established entities and early user adoption as indicators of a startup’s viability and potential for success. These requirements can sometimes push startups into traditional frameworks and infrastructures, even within innovative fields like blockchain.

Why VCs Value Partnerships and User Adoption

- Risk Mitigation: Partnerships with established companies can signal that the startup has passed certain due diligence checks, reducing the perceived risk for investors.

- Market Access: Established partners can provide market access, credibility, and resources that might be difficult for a startup to achieve on its own.

- Validation: Early user adoption, even on a small scale, serves as a proof of concept that there is market demand for the startup’s offerings.

Challenges for Startups

- Compromise on Innovation: To secure partnerships, startups might need to align their products or services more closely with existing systems, which can sometimes water down their innovative aspects.

- Dependency: Relying on established networks can create dependencies that may inhibit the startup’s ability to pivot or adapt in the future.

- Dilution of Vision: In trying to meet investor criteria for partnerships and early adoption, startups might stray from their original vision, potentially compromising on the disruptive potential of their technology.

Even as blockchain aims to decentralize many aspects of technology and finance, the evolution of its ecosystems often requires a blend of centralized and decentralized methods, especially in nascent stages.

Execution & Delivery

When a business or organization chooses between a “for-profit model” or a “for decentralization” model, it’s not just selecting a financial framework but also defining its core values and operational principles. The choice reflects the entity’s commitment either to maximizing profits for shareholders or to spreading power and benefits more evenly across its network of participants. We are still a long way from achieving this.

Proposed Mitigation Strategy

In the rapidly evolving blockchain and cryptocurrency ecosystem, promising projects with strong technical fundamentals often struggle to gain visibility and attract resources. The space is increasingly dominated by hype-driven speculation and over-commercialization, leading to the proliferation of “meme coins” and other assets with little intrinsic value unlocked. This trend disadvantages serious developers and innovators, hindering the growth of truly transformative technologies.

To address this issue, we propose the creation of a “BlockTech500” decentralized index fund that selects ranks for blockchain assets based on rigorous technical reviews and quantitative metrics. By shifting focus to fundamental technical strengths, this index aims to surface undervalued projects, provide a more efficient allocation of capital, and align incentives between investors and developers building the future foundations of Web3.

Key Benefits

- Amplifying developer mindshare and attracting talent to technically meritorious projects.

- Providing an alternative to hype-based speculation and promoting fundamental value investing.

- Leveraging the wisdom of technical experts in a scalable, decentralized manner.

- Enabling a community-led governance model for index curation and evolution.

Index Methodology

Quantitative Review Criteria

Definition: Let P = \{p_1, p_2, \ldots, p_n\} be the set of candidate blockchain projects. Each project p_i is evaluated across m criteria C = \{c_1, c_2, \ldots, c_m\}, which include:

Primary Criteria:

- Decentralization: Measured by node distribution, consensus mechanism robustness, Nakamoto coefficient. Denote as c_1(p_i).

- Scalability: Quantified by transaction throughput, block latency, state storage efficiency. Denote as c_2(p_i).

- Privacy: Assessed by the strength of privacy primitives, data obfuscation techniques, zero-knowledge proof schemes. Denote as c_3(p_i).

- Security: Score incorporating cryptographic primitives, attack resistance, formal verification, bug bounty programs. Denote as c_4(p_i).

- Innovation: Evaluates novel consensus algorithms, virtual machine architectures, smart contract languages. Denote as c_5(p_i).

- Censorship Resistance: Measures the cost and difficulty of censoring transactions, smart contracts, and user activity. Denote as c_6(p_i).

- Productivity: Quantifies developer productivity based on gas efficiency, contract deployment cost, tooling quality. Denote as c_7(p_i).

Tiebreaker Criteria:

- Community Engagement: Aggregated from platform usage, transaction volume, social sentiment. Denote as c_8(p_i).

- Adoption: Quantified by dApp ecosystem growth, institutional partnerships. Denote as c_9(p_i).

- Exposure: Measures brand awareness, media coverage, search interest. Denote as c_{10}(p_i).

Data Aggregation

On-chain metrics for the above criteria are computed using SQL queries on data indexed by Dune Analytics:

-- Calculate Nakamoto coefficient

SELECT

1.0 - sum(power(balance / total_balance, 2)) AS nakamoto_coeff

FROM (

SELECT

sum(value) AS balance

FROM addresses a

GROUP BY 1

ORDER BY 1 DESC

LIMIT (SELECT greatest(1, ceil(0.01 * count(distinct address))) FROM addresses)

) t, (SELECT sum(value) AS total_balance FROM addresses) t2;

Off-chain data from Github, social media, and VC deal flow are integrated to derive a holistic project view.

Scoring & Weighting

A weighted sum of criteria scores ranks each project:

with weights w_j satisfying \sum_j w_j = 1 and higher weight on primary criteria.

Index Rebalancing via Versus Battles

Reputation and Rewards

Voters:

-

Users who vote correctly (i.e., their vote aligns with the final outcome) see an increase in their reputation score, while users who vote incorrectly lose reputation.

-

The magnitude of the reputation change for voters is constant, regardless of the number of ranks skipped in the challenge.

-

Voters’ rewards are determined strictly by their voting reputation weights, with higher reputation scores leading to higher rewards for correct votes.

Proposers:

-

If a proposer initiates a challenge and the challenger token wins, the proposer’s reputation weight increases by a fixed amount, regardless of the number of ranks skipped. The proposer’s reward is calculated as follows:

-

for each rank skipped, the proposer receives an additional 1x their initial bet (e.g., if the proposer challenged a token one rank above and won, their reward would be 2x their initial bet; if they challenged a token two ranks above and won, their reward would be 3x their initial bet).

-

If the proposer initiates a challenge and the higher-ranked token maintains its position, the proposer loses their bet and also loses reputation weight. The reputation weight loss for proposers is 1x for each rank skipped in the challenge.

Workflow Example

Consider the following example of a proposer-initiated versus match:

Voters:

-

Users who voted correctly (i.e., in alignment with the final outcome) see an increase in their reputation score.

-

The magnitude of this increase is constant, regardless of the number of ranks skipped in the challenge. Users with higher reputation scores receive higher rewards for their correct votes. Users who voted incorrectly lose reputation.

Proposer:

-

If the challenger token t_C wins, the proposer’s reputation weight increases by a fixed amount, and their reward is calculated as follows:

-

they receive their initial bet of 1000 tokens plus an additional 1000 tokens for skipping one rank, resulting in a total reward of 2000 tokens (2x their initial bet).

-

If the higher-ranked token t_A maintains its position, the proposer loses their bet of 1000 tokens and 1x reputation weight, as the challenged token was one rank above the challenger.

Governance & Incentives

BlockTech500 is governed by a DAO that votes on disputed versus results, proposals, and criteria adjustments.

Initial Index Composition and Asset Addition Process

The initial composition of the BlockTech500 index will be determined through a rigorous, multi-stage process designed to identify the most technically meritorious blockchain projects at the time of launch. Let \mathcal{U} denote the universe of all eligible blockchain assets, and let \mathcal{I}_0 \subseteq \mathcal{U} represent the initial index composition.

As the blockchain ecosystem evolves over time, it will be necessary to periodically update the index composition to reflect the emergence of new technically meritorious projects. To this end, we propose the following asset addition process.

This two-part methodology, consisting of a rigorous initial selection process and an ongoing asset addition/removal mechanism, is designed to maintain the BlockTech500 index’s compositional legitimacy over time. By subjecting all assets, both initial and subsequent, to the same comprehensive technical evaluation process, we ensure that the index remains a true reflection of the most meritorious projects in the evolving blockchain landscape.

Moreover, the use of a diverse panel of independent experts (DAO Governance Delegates) which need to be nominated and win enough user votes to be in the top voted on nominees so that they are allowed to stake X tokens and become a delegate and a transparent, scoring system helps to mitigate potential biases and conflicts of interest in the index construction process. The inclusion of a deliberative weight-setting process allows for the incorporation of qualitative expert judgment while still maintaining a high degree of objectivity and repeatability. To become a delegate of the DAO you must stake X amount of tokens and they must vote among themselves to come up with dispute resolutions. they too have rep scores, but not weighted ones in the sense of voting power. but those always opposing the majority vote, would risk being replaced for underperformance at each quarterly review and nomination and election cycle of delegates. as the lowest performing ones could be replaced by new nominees if the voters lean that way

Ultimately, while no index construction methodology is perfect, we believe that the proposed approach strikes an appropriate balance between rigor, objectivity, and adaptability. By carefully managing the initial index composition and instituting a robust asset addition process, the BlockTech500 index can serve as a legitimate and enduring benchmark for technical merit in the dynamic world of blockchain technology.

Comparisons

Sure, let’s correct that section with a comparison to Messari.

Messari vs. BlockTech 500 Index

-

Decentralization:

-

Messari: Provides comprehensive research and data analysis on various blockchain projects, including decentralization metrics. Messari evaluates node distribution, consensus mechanisms, and other decentralization factors to assess the overall robustness and security of blockchain networks.

-

BlockTech 500 Index: Evaluates projects on decentralization by examining node distribution, consensus mechanism robustness, and the Nakamoto coefficient. This ensures that projects are judged on their true decentralization and security merits, similar to Messari’s approach.

-

-

Community Engagement:

-

Messari: Engages the community through detailed research reports, market analysis, and data dashboards. While it provides extensive insights and allows user interactions, it does not incorporate direct community voting for project evaluations.

-

BlockTech 500 Index: Incorporates versus voting challenges where the community actively participates in ranking decisions, increasing engagement and ensuring the community’s voice plays a crucial role in project evaluations. This gamified approach can drive higher community involvement compared to Messari.

-

-

Indexing Mechanisms:

-

Messari: Focuses on providing in-depth research, market data, and analysis for blockchain projects. Messari offers tools and resources for tracking project metrics, market performance, and industry trends, but it does not maintain a dedicated index ranking system based purely on technical evaluations.

-

BlockTech 500 Index: Provides a structured, transparent ranking system that evaluates projects based on a wide range of technical criteria, helping highlight technically strong projects and providing them with the necessary visibility. The index aims to shift focus to fundamental technical strengths, offering an alternative to hype-driven market rankings.

-

By focusing on core technical attributes such as decentralization, scalability, privacy, and security, the BlockTech 500 Index can highlight projects that are technically robust and innovative, similar to how Messari provides detailed insights but with an added layer of community-driven evaluation and gamified engagement.

The Graph Network

1. Decentralization:

-

The Graph: Uses a network of nodes to index data from multiple blockchains, relying on economic incentives through the Graph Token (GRT) to maintain decentralization. Indexers stake GRT to participate, and curators signal high-quality subgraphs by staking GRT.

-

BlockTech 500 Index: Emphasizes decentralization through comprehensive technical evaluations, including scalability, privacy, security, innovation, censorship resistance, and productivity.

2. Community Engagement:

-

The Graph: Community engagement is driven through the roles of curators, indexers, and delegators. Each role is incentivized to participate and ensure the quality of the indexed data. Curators earn rewards for identifying valuable subgraphs.

-

BlockTech 500 Index: Adds an interactive element to community participation with versus voting challenges. This direct involvement can drive more engagement and a sense of ownership among community members.

3. Indexing Mechanisms:

-

The Graph: Provides a decentralized indexing and querying protocol for blockchain data, using GraphQL to make the data easily accessible. Indexers stake tokens to ensure data reliability, and the system uses economic incentives to maintain integrity.

-

BlockTech 500 Index: While not a data indexing protocol, it offers a comprehensive ranking system based on technical evaluations, aiming to provide visibility and credibility to technically strong projects, which might otherwise be overlooked due to a lack of community engagement or exposure.

Currently there aren’t any Cryptocurrency ranking and review dapps or tools that allow for this level of gamification and precision where high quality decentralized community level insights which can be incentivized in such an exact approach as head to head comparisons which are broken down even further into categories.

Advantages & Benefits

Increasing Visibility and Credibility

-

Highlighting Technical Merit: By focusing on core technical attributes such as decentralization, scalability, privacy, and security, the index brings attention to projects that are technically robust and innovative, even if they have not yet built a large community or gained significant exposure.

- Case Study: Projects like Algorand and Polkadot, which are technically advanced, have benefitted from increased visibility through rankings and technical evaluations despite initially having smaller communities compared to giants like Ethereum.

-

Attracting Funding and Partnerships: Being featured in a prestigious, technically-focused index like the BlockTech 500 can attract investors and partnerships. Investors often look for technically sound projects that have the potential for growth. This can provide the necessary capital for these projects to further develop their community and market presence.

- Example: Technical excellence often attracts venture capital interest. For example, projects that focus on innovative consensus algorithms or novel scalability solutions can secure funding from tech-savvy investors looking for the next breakthrough.

Facilitating Community Growth

-

Building Trust: Inclusion in the BlockTech 500 Index can serve as a stamp of approval for technical quality, helping to build trust among potential users and developers. This can drive community engagement as more individuals and organizations feel confident in participating.

- Impact: Trust can lead to increased participation from developers and users, which is crucial for community growth. Projects with high technical ratings can see a surge in developer interest, leading to more contributions and improvements.

-

Leveraging Exposure: The exposure from being listed in the BlockTech 500 can help technically strong projects that lack marketing prowess or community engagement to gain visibility. This can lead to organic growth as more people become aware of the project’s potential and start contributing to or using the technology.

- Example: Innovative blockchain projects that receive media coverage and analyst attention due to their technical merits can experience a significant increase in community interest and engagement.

Addressing the Innovation Gap

-

Encouraging Innovation: By recognizing and rewarding technical innovation, the index encourages projects to focus on developing new technologies and solutions. This can lead to a healthier blockchain ecosystem with a variety of robust, innovative projects.

- Outcome: Projects that might have otherwise remained unnoticed due to their lack of marketing can gain the spotlight, promoting a diverse range of solutions and technologies in the blockchain space.

-

Support for Undervalued Projects: Projects that are technically sound but undervalued in the market due to lack of exposure can benefit from the structured and transparent evaluation provided by the BlockTech 500 Index. This can help level the playing field, ensuring that technical merit is recognized and rewarded.

- Benefit: This helps ensure that good technology does not go unnoticed and that resources are allocated more efficiently within the blockchain ecosystem.

In conclusion, the BlockTech500 Index can significantly help projects that are strong in innovation and technical aspects but lack in community and other tiebreaker attributes. By providing these projects with increased visibility and credibility, the index can attract funding and partnerships, build community trust, and ultimately ensure that technical excellence is recognized and rewarded.