..and a visual demonstration.

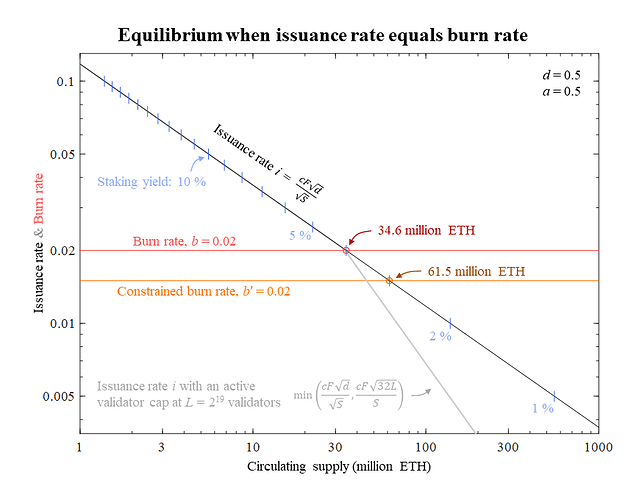

Figure A illustrates the equilibrium with the burn rate and issuance rate on the y-axis, and the circulating supply on the x-axis. In this example, both the deposit ratio and the variable a that controls the reduction of the burn rate based on the amount of staked ether was set to 0.5. The issuance rate falls with increased supply, while the burn rate and constrained burn rate are not related to the circulating supply. Therefore, the lines will cross. The equilibrium is located at the point where the lines cross.

Figure A. The equilibrium illustrated by letting the y-axis represent both the burn rate b (red line) and issuance rate i (black line), with the circulating supply on the x-axis. The grey line indicates the issuance rate with a 2^{19} active validator cap. Circles indicate the equilibrium which is located at the points where the lines for the burn rate and issuance rate cross. The staking yield (excluding tips) is indicated in blue and the constrained burn rate b’ set as 0.02 in orange. Vector graphics for the figure: BurnIssuanceEquilibrium.pdf (147.2 KB)

As evident, the burn rate b and the constrained burn rate b’ differ by a constant factor in the figure. This means that even when the burn rate is reduced by discounting staked ether, there will still be an equilibrium–the burn-rate curve is still independent of the circulating supply and just shifted downwards in the figure. Similarly, yield demand can influence the deposit ratio, shifting the burn-rate curves up and down, or shifting the issuance-rate curve left or right. The relationship between b and b' can be clarified by rearranging the equation for the constrained burn rate

b’ = \frac{B}{S-aD},

b’ = \frac{B}{S-adS},

b’ = \frac{B}{S(1-ad)},

b’ = \frac{B}{S}\frac{1}{1-ad},

and substituting in b

b’ = \frac{b}{1-ad}.

This relationship makes it possible to compute the burn rate for the constrained burn rate as in the example presented in the figure:

b = b'(1-ad) = 0.02(1-0.5\times0.5) = 0.015.