As part of researching cross-shard transactions the TXRX research team has built a cross-shard transaction simulator named Vorpal.

All of the probabilistically generated data can be found here: https://drive.google.com/drive/folders/1sloCwAnJ2Ok2zkuwjtBaFbyZdag-z4Dy?usp=sharing

Throughput is tracked using two metrics, transactions and transaction segments detailed in this previous research post. Transaction segments are portions of a transaction that result from a cross-shard call, where the transaction is the encapsulation of all the transaction segments.

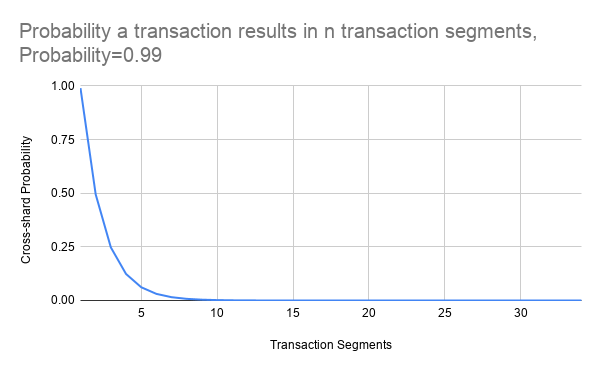

How cross-shard transaction probabilities are calculated. After each transaction segment the cross-shard probability is recomputed resulting in a decaying probability for the encapsulating transaction.

Below is an example of a cross-shard probability calculation at a probability = 0.99, and the x axis is the resulting transaction segments

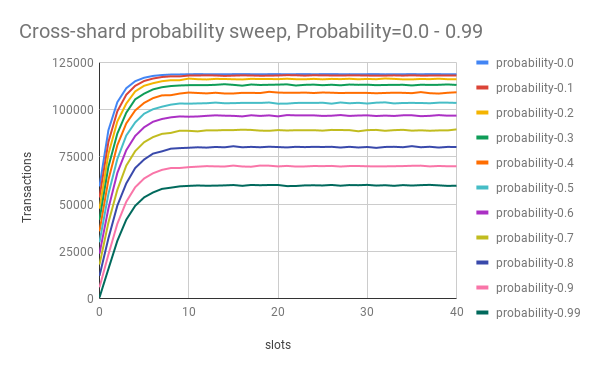

Test: Probabilistic cross-shard sweep

This test is a sweep of the --crossshard value from 0.0 - 0.99 over multiple simulations. --crossshard is the probability a cross-shard call will occur within a transaction.

Results

Configuration

collision_rate 0.0113712

shards 64

slot 12

blocksize 512

witnesssize 256

transactionsize 1

tps 10000

duration 500

probability 0.0 - 0.99

collision 0.01

sweep FALSE

generate FALSE

output None

outputtransactions None

input None

Conclusion

As the probability of a cross-shard transaction increases linearly there is an exponential decrease in transactional throughput. At the maximum value of a cross-shard probability = 0.99 represents a ~0.503 proportional decrease in transaction throughput.

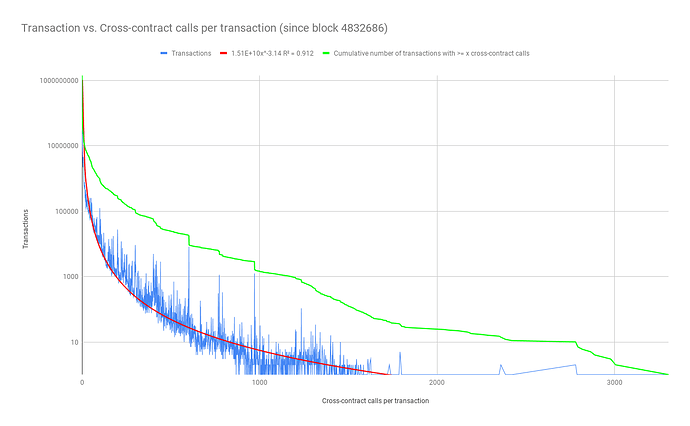

An average Eth1 transaction contains ~1.33 cross-contract call per transaction.

Assuming shards will have a uniform distribution of contracts the probability of a cross contract call resulting in a cross-shard transaction is 63/64 = ~0.984375 which is very close to the right hand side of this exponential slope. Resulting in ~1.315 cross-shard calls per transaction without any contract modifications or load balancing.

Recommendations

As a recommendation contract yanking should be implemented as part of the protocol to allow shard balancing.

Cross-shard calls should be economically priced to incentivize the utilization of contract yanking.

Next Steps

As part of this research the next steps will be to run Eth1 transactions into the simulator to capture non-probabilistic scenarios. Additionally, contract yanking will be tested to detect if there is a improvement in transactional throughput. Investigate in-protocol control loop based contract yanking.