The Ethereum Ecosystem struggle to bridge between on-chain value and everyday usability.

While NFC wallets (like Tangem, Citizen Wallet or Ledger backups) have introduced contactless interactions, they often remain tied to traditional wallet paradigms.

This proposal introduces Crypto Native Cash (Native Cash). A system that binds on-chain value to physical objects. Such as banknotes.

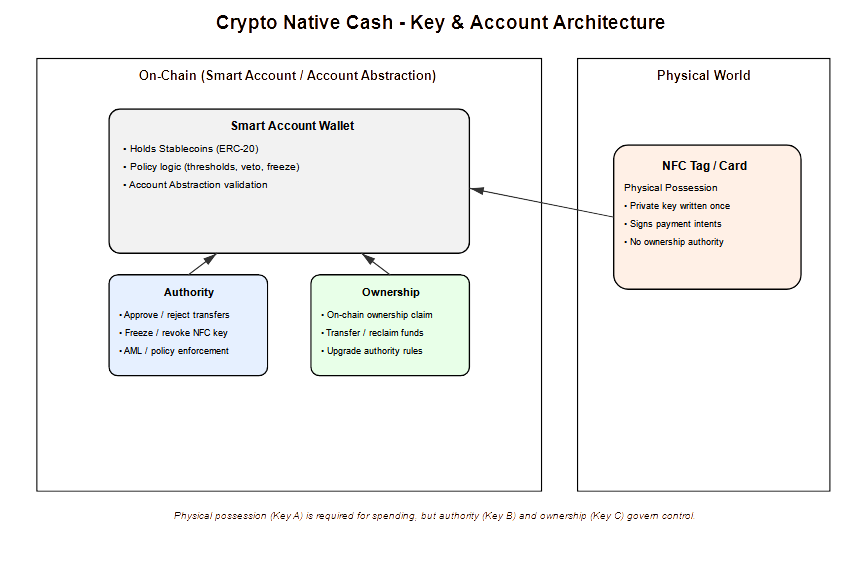

Realized through Account Abstraction (ERC-4337), NFC, and a multi-layered governance model to enable the immediacy of paper cash in DeFi while providing the programmable security of crypto.

This creates a hybrid economy where Central Bank regulated safety meets the programmable flexibility and decentrality of DeFi.

Motivation

For mainstream adoption, DeFi must map to existing human patterns of tangibility and offline transferability.

The goal is to create a banknote that costs approximately 0.3 EUR at maximum to produce, is collectible, and operates in a L1/L2/L3 sync composability environment.

By separating the account from a single private key, we can create a system that mirrors the relationship between a citizen and a central bank.

Governance Model

The model moves away from the single private key model, which is too fragile for physical objects and common usability patterns.

Instead, the Smart Account governed by three keys:

-

Key A: Physical Possession (NFC tag/NFC Banknote)

- A private key derived from an NFC chip’s UUID or embedded in the data payload.

- This key is required to sign payment intents but has no ownership authority. It can only spend within policy constraints.

-

Key B: Authority (Central Bank/Guardian)

- A revocable authority held by a central bank, banking consortium, DAO, or parent

- This key enforces AML policies, sets spending thresholds, and acts as a kill switch to freeze the account if the physical item is lost.

-

Key C: Ownership (Economic Claim)

- An on-chain claim (can be a DAO or NFT too) that holds the ultimate right to the assets.

- It can transfer the account, reclaim funds, or request to upgrade authority rules

Movement and the Physical Lifecycle

The core idea is to bind the tokens to a smart account and physical item.

This allows for two distinct modes of movement:

- Physical P2P Transfer (Off-Chain Possession)

Because the value is bound to the physical banknote (Key A), possession of the object implies the right to use it for small, cash-like payments.- Trustless Verification: Recipients can check the on-chain status of the banknote to ensure the funds haven’t been frozen or revoked by the Authority (Key B).

- Low Friction: No complex device setup is needed for small payments, mirroring the simplicity of paper cash. Only moving the Economic Claim around.

- Destructive Settlement

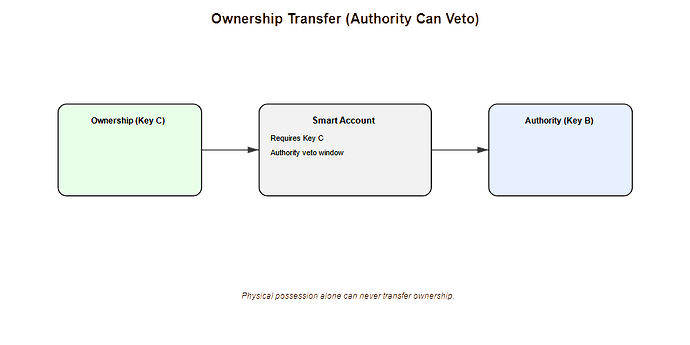

To move the on-chain value to a new address, the current physical object must be killed on-chain by destroying the physical item.- Revocation and Reissue: The old Key A is permanently removed from the Smart Account’s validation logic, and a new one is added. The added key has be the owner of the Economic Claim.

- Symbolic Destruction: The physical destruction of the banknote is mostly symbolic, but serves an important part for the physical economy.

Therefore this process has to happen in a temperproof environment. The on-chain movement is the real mechanism that prevents double-spending.

An physical exchange can be used as intermediary here. Providing another layer of privacy, yet auditable physical and digital trace.

AML policies set by the authority apply here. The Authority may freeze the assets or block transfers.

Transaction Flows: From Micropayments to Regulated Transfers

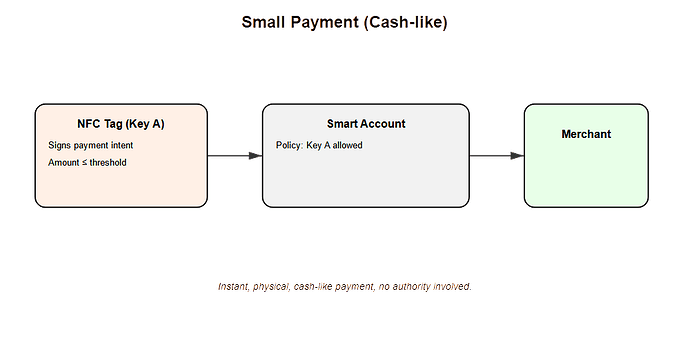

- Small Payments (cash like): The physical tag (Key A) signs a payment intent within an allowed threshold. No external approval is needed, enabling instant, physical exchange.

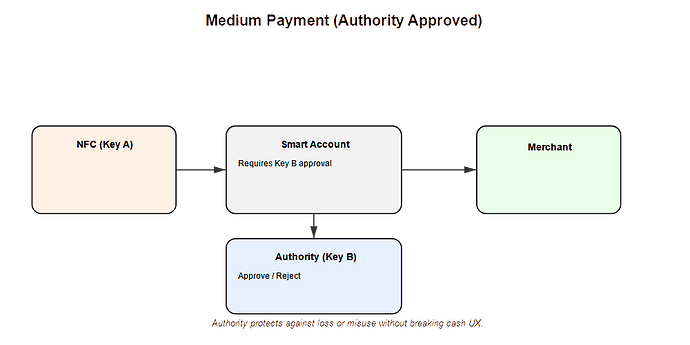

- Medium/Large Payments (Authority Approved): Transactions exceeding a threshold require Key B (Authority) and/or Key C (Economic Claim) to approve or reject the move.

This protects against large-scale theft or money laundering while maintaining the cash UX for daily needs.

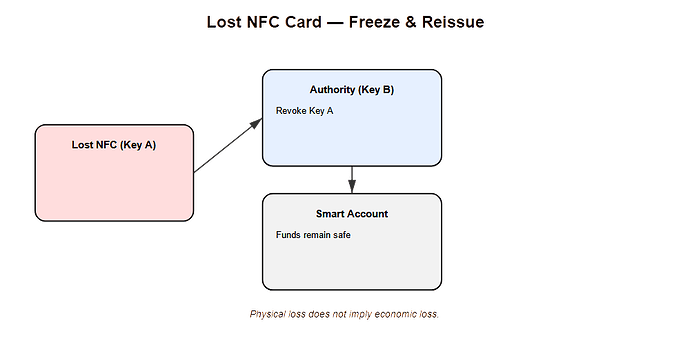

Dealing with physical Loss

Unlike physical Central Bank notes, losing a Crypto Native Cash does not necessarily mean losing the funds.

- Freezing: The Authority (Key B) can invalidate the functional permissions of the lost Key A.

- Safety: The funds remain safely bound to the Smart Account, accessible to the owner (Key C) through a higher-trust recovery process

Key C (owner of the assets) can request to issue a new NFC tag and link it to the existing assets, maintaining the same on-chain identity.

Security and Programmability

This architecture introduces features that traditional paper cash lacks:

- Threshold Signatures (FROST or Threshold ECDSA): Enables T-of-N approvals so multiple guardians (a family or DAO) must approve high-value moves. Authorities may be inherited.

- Revenue Splits: Automated on-chain distribution of fees to vending operators, designers, and investors. Destructive Settlment on-chain within the vending machine.

Psychological Onboarding into web3

To normalize the idea of programmable cash, we must engage users through tactile feedback and playful interactions.

A psychological approach is need to break holdl culture apart and using available liquidity in existing economic systems.

- Gamified Distribution: Using Gachapon vending machines to dispense crypto native cash that can be used to buy “tinyblock” kits or other physical collectibles

- Tactile Feedback: Kits that interact with the crypto native cash (using lights or sound) link the physical object to its on-chain identity, turning a technical interaction into a social one

- Authenticity: Physical collectibles can be linked to digital collectiable (e.g. NFTs), making the banknotes collectible assets in their own right.

Evolving NFTs that change with the velocity can further embrace the psychological component and motivate people to spent their crypto native cash.

This model enables the Ethereum ecosystem a path to create not only the digital economy, but the physical one. It enabled a regulated, user-friendly bridge that feels exactly like the cash we already know, but with the security of the future.