Special thanks to Nathan from Factomind for his valuable advice on the design of the derivatives market.

TL;DR

This article introduces a derivatives market designed to implement based sequencing for fast finality in rollups. The proposed market aims to align incentives between Ethereum and rollups, mitigate operational risks associated with rollups, and promote voluntary participation and fair competition among rollups, proposers, and builders.

The unique design allows rollups to act as preconf providers, offering users fast preconfirmation while minimizing censorship, sandwich attacks, and frontrunning risks.

For the full proposal, please refer to the complete blog post. This summary covers only the key design aspects.

Motivation

If rollups, acting as preconf providers, pay proposers to pre-purchase the block building rights for specific slots, they can deterministically promise settlement to users by owning the Ethereum block. This mechanism allows rollups to achieve fast preconfirmation through self-sequencing. However, the difficulty in predicting future block prices introduces operational risks for rollups. To offset these operational risks and create a fair market that encourages active participation from traders, I propose a series of derivatives.

This idea is connected to the implementation of delegated preconf mentioned in @JustinDrake based preconfirmation.

Forward Contract

The process of a rollup purchasing the block building rights for a specific slot from a proposer can be likened to a forward contract in financial markets. To understand the operational risks a rollup might face in this transaction, let’s consider a basic scenario involving a 32-slot lookahead for the proposer and a slot auction.

- At t = 1, the rollup participates in a slot auction to purchase a forward contract with the proposer for a specific slot.

- From t = 2 onwards, after securing the slot, the rollup sequences its users’ transactions, providing preconfirmation to users and generating revenue from the block.

- At t = 3, the rollup requests the execution of the forward contract, compressing its transactions into an Ethereum block and submitting them to the proposer.

- At t = 4, the proposer fulfills the contract by signing the received block and proposing it on Ethereum.

Operational Risks for Rollups

- Excessive Payment Risk: Rollups may find it challenging to accurately predict block value, leading to overpayment for block space. This occurs because they have to participate in slot auctions and purchase the entire space even if they only need a portion for settlement.

- Revenue Uncertainty: Rollups cannot reliably predict their future revenue. If transaction costs exceed revenue, they may face potential financial risks.

- Increased Labor Costs: To ensure stable operations, rollups must now engage in activities such as predicting Ethereum block values, competing with builders, and accurately forecasting revenues, which were previously unnecessary.

Derivative Market

To mitigate the operational risks faced by rollups, we propose a derivatives market involving specialized participants, builders. This market includes two key derivatives: a forward contract between the builder and the proposer, and a swap contract between the rollup and the builder.

- At t = 1, the builder participates in a slot auction and enters into a forward contract with the proposer for the block building right.

- At t = 2, the rollup and the builder enter into a swap contract. This contract obligates the builder to include the rollup’s transactions in the block.

- At t = 3, utilizing the block building right secured through the swap contract, the builder constructs the rollup block up until t = 4, thereby generating revenue.

- At t = 4, the rollup demands contract fulfillment according to the obligations stipulated in the swap contract:

- The rollup requires the builder to include its transactions in the Ethereum block secured through the forward contract.

- To maximize revenue, the builder places the rollup’s transactions at the bottom of the Ethereum block and its own transactions at the top, forming a complete block.

- At t = 5, the builder delivers the Ethereum block to the proposer, who then proposes it on Ethereum, fulfilling the forward contract.

Motivation for Participation

- Rollup: Rollups participate to provide deterministic preconfirmation to users regarding their inclusion in Ethereum, while mitigating the operational risks associated with purchasing block space. Preconfirmed transactions are guaranteed inclusion in the Ethereum block, avoiding the risk of spending more than their revenue on block space. This eliminates the need for unnecessary labor in price prediction and auction participation.

- Builder: Builders participate to reduce the risk of overpayment from slot auctions. The secured Ethereum block space, along with the rollup block, offers dual revenue streams, diversifying and reducing the risk of loss.

- Proposer: Proposers participate to receive compensation for rollup preconfirmation. Builders consider the revenue generated from rollup blocks when bidding in slot auctions, aligning proposer incentives with rollup settlement.

Additional Design

To effectively implement these financial products, it is crucial to create an environment where all participants can compete fairly and engage actively. This involves three key additional design elements.

Conditional Swap Contract

Rollups may be hesitant to participate if they are required to allocate all potential revenue opportunities to builders through a swap contract. To encourage rollup participation, a conditional swap contract is proposed.

In this arrangement, if the builder generates profits from the rollup’s block building that exceed the fixed costs paid in the forward contract with the proposer, the rollup is allowed to stop providing the remaining block space to the builder. The rollup can then use the remaining block space to either build independently or auction it to builders for additional revenue.

This approach preserves the builder’s incentive to participate while protecting the rollup’s opportunity to generate revenue.

Competitive Proposer Market

Settlement is essential for rollups to inherit Ethereum’s security. When rollups are compelled to purchase blocks, proposers/builders gain significant pricing power, potentially leading to an uneven playing field that undermines market fairness and efficiency.

To reduce the pricing power of any single builder, multiple builders should be encouraged to participate in swap transactions, fostering competition among them. This requires expanding the forward contract market to include multiple proposers with block building rights for different slots.

Such a structure ensures that the variable value of the rollup’s block aligns more closely with the fixed cost of acquiring Ethereum block space. This is analogous to achieving a ‘par value’ of zero for swap contracts in a competitive market, maintaining reasonable costs for rollups. The lookahead necessary to achieve this par value requires further discussion.

Syndicated Rollup Strategy: Derivatives for All Rollups

Builders may be unwilling to engage with rollups that have relatively low block value, potentially marginalizing app-specific rollups in the market.

The Syndicated Rollup Strategy groups multiple rollups into a syndicate, enhancing their market participation. Cross-rollup arbitrage has the potential to increase the value of each block. Builders receive the block building rights for the rollups in the group, and the rollups require the builder to include all group transactions in the Ethereum block.

Building Blocks in Rollups

This section describes how builders secure rollup block building rights through swap contracts, focusing on censorship resistance and fast preconfirmation for user-centric rollups.

Censorship Resistance

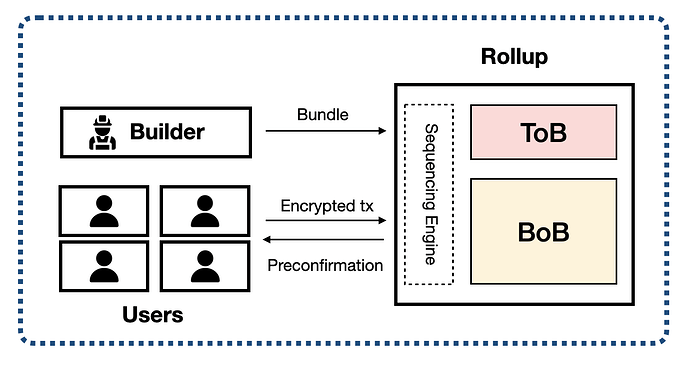

In a structure similar to Proposer-Builder Separation (PBS), rollups that enter into swap contracts receive blocks from builders and execute them. However, this setup may expose users to censorship, sandwich attacks, and frontrunning by builders. Rollups can address these issues by integrating Radius’s sequencing engine.

- Encrypted Mempool (using delay encryption): Users’ transactions are encrypted until the promise of inclusion in the rollup block is issued.

- Decryption and Execution: Once inclusion is confirmed, transactions are decrypted and executed by the rollup, providing preconfirmation similar to standard transactions.

- Economic Order Guarantees: By assigning an order to the inclusion promises, the economic guarantees ensure that transactions cannot be reordered after decryption, minimizing the risk of frontrunning and sandwich attacks.

Fast Preconfirmation

Rollups can achieve fast preconfirmation by designating the preconf provider as their sequencer and implementing self-sequencing. Block space is divided into two segments: Top-of-Block (ToB) and Bottom-of-Block (BoB).

-

Top-of-Block (ToB): This space is allocated to the builder under the swap contract. The builder creates a backrunning bundle based on the rollup’s previous block state and submits it to the rollup’s sequencer.

-

Bottom-of-Block (BoB): This space is reserved for end-user transactions. The rollup sequences these transactions and provides preconfirmation.

Using Radius’s sequencing engine in BoB protects users’ transactions from censorship by the sequencer and harmful MEV by the builder, as the builder cannot see the user’s transactions when creating the ToB.

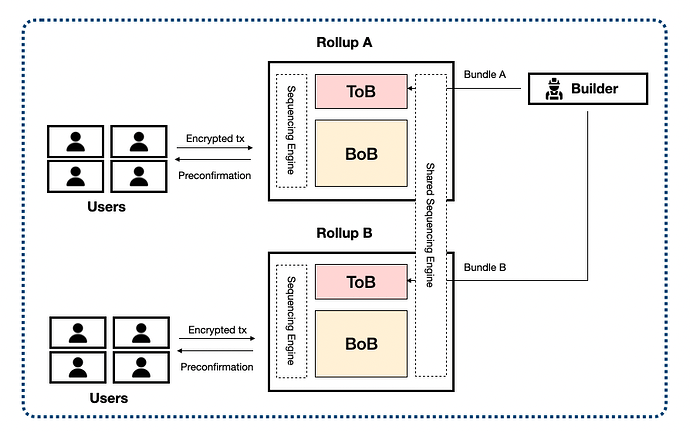

Syndicated Rollup Strategy

In a syndicated rollup strategy, a group of rollups entering into swap contracts with a builder allocates ToB space to the builder. The builder submits a cross-rollup bundle to be included in the ToB.

A Shared Sequencing Engine aims to ensures smooth contract execution between rollups and builders. It will verifies that the builder submitting the bundle is a party to the swap contract and is designed to ensure that all rollups in the group fulfill the contract by including the builder’s submitted bundles in ToB.

Rollups can choose the shared sequencing engine for BoB sequencing. This allows the selected sequencer to act as a shared preconf provider, supporting atomic inclusion for end-users across multiple rollups.

Conclusion

I am enthusiastic about the future of a rollup-centric Ethereum and am dedicated to exploring designs that benefit rollup users. A derivatives market that incentivizes voluntary participation of Ethereum for rollup settlements can significantly contribute to the effective implementation of based sequencing. My future research related to the derivatives market includes the following areas:

- Exploring the technical requirements necessary for market implementation.

- Updating the design to accommodate rollups utilizing blobspace.

- Proposing additional designs that can contribute to Ethereum’s decentralization, potentially considering the separation of beacon proposers and execution proposers as suggested in @mikeneuder Execution Ticket and @barnabe APS-Burn.

Beyond the derivatives market, I am exploring various methods for implementing based sequencing. I look forward to contributing to this field through diverse feedback and collaboration within the community.