Empirical Analysis of the EIP-4844’s Impact on Ethereum

Summary

On March 13, 2024, Ethereum implemented EIP-4844 to enhance its capabilities as a data availability layer. While this upgrade has successfully reduced data posting costs for rollups, it also introduces potential concerns regarding the consensus layer, particularly due to increased propagation sizes. Additionally, the broader impacts on the overall Ethereum ecosystem have not been thoroughly explored until now.

In our analysis, we’ve examined EIP-4844’s effects in terms of consensus security, Ethereum usage, rollup transaction dynamics, and the blob gas fee mechanism. Our study includes changes in synchronization times, detailed assessments of Ethereum usage, rollup activities, and insights into the blob gas fee mechanism. Our goal is to pinpoint both improvements and potential issues since the upgrade.

Main Findings:

- Consensus Security

- Increase in fork rates, even excluding periods affected by client issues.

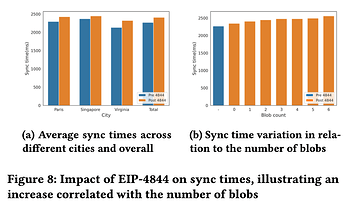

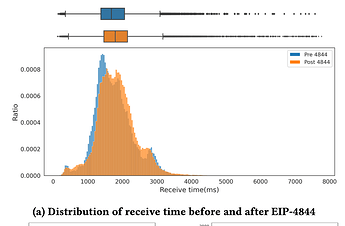

- Sync time has increased by approximately 140ms, from 2267.436ms to 2407.05ms.

- The most significant contributor to increased sync time is receive time, while blob propagation had minimal effects.

- Ethereum Usage

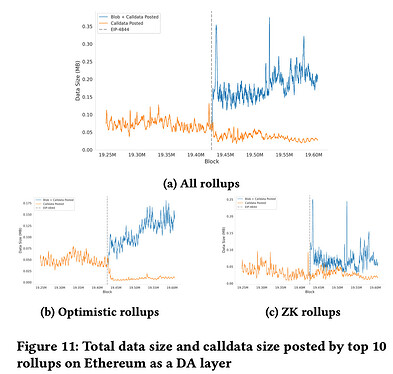

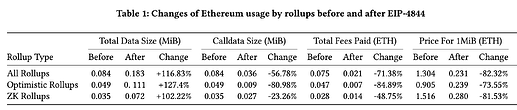

- Marked increase in total data size posted by rollups (+116%).

- Significant reduction in total fees paid by rollups (-71%) and price per MiB for data availability (-82%).

- A substantial decrease in total gas used (-54%).

- Rollup Transactions

- All six rollups studied (Arbitrum One, Optimism, Base, Starknet, zkSync Era, Linea) showed significant increases in transaction volume.

- User delay has notably increased in four of the rollups(except for Arbitrum One and zkSync Era), highlighting the need for blob sharing protocols.

- Blob Gas Fee Market

- Small influence of the gas base fee on the blob gas base fee, with no reciprocal influence detected.

- Higher priority fees for blob transactions compared to non-blob transactions

- The blob gas fee market exhibits greater volatility than the gas fee market, yet it potentially reflects market demands more accurately.

Figures

We will also open our code&dataset soon.

We hope to offer a deeper understanding on the post-upgrade effects and encourage discussions that can help improve the Ethereum ecosystem. Your feedback and insights would be greatly appreciated.