This post proposes a self-contained futarchy mechanism for bonding curve tokens.

Problem

Decentralized exchanges are likely the best price-finding solution for futarchy markets but, until they’ve achieved sufficient usability and liquidity, futarchies must be self contained providing their own price-finding mechanism. The current best know solution is to use an LMSR automated market maker but this presents a significant challenge. Each LMSR market must be funded up front in order to provide liquidity to market participants. This places a significant burden on the party that needs to provide the funding.

Bonding Curve Futarchy

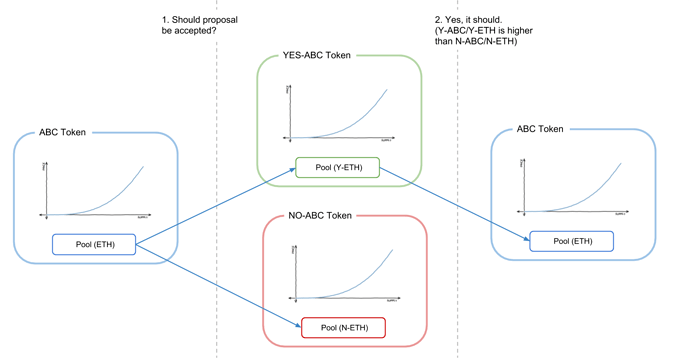

A bonding curve token has a built in price-finding mechanism as well as a reserve pool of funds. This can be used to create a relatively simple and self-contained futarchy mechanism. The mechanism works like this:

- Start with a bonding curve token

ABCwhere its bonding curve usesETHas the reserve token. - A decision to accept a new proposal is started with a

YESorNOoutcome. - Two tokenized events are started allowing the conversion of

ABCinto the outcome tokensYES-ABCandNO-ABCandETHintoYES-ETHandNO-ETH. If the decision isYES,YES-ABCtokens can be exchanged forABCtokens andYES-ETHcan be exchanged forETH. Likewise, if the decision isNO,NO-ABCtokens can be exchanged forABCtokens andNO-ETHcan be exchanged forETH. - The main bonding curve is halted and two new bonding curves are created that mint

YES-ABCandNO-ABCin exchange for their respective reserve tokensYES-ETHandNO-ETH. - The main bonding curve’s reserve (

ETH) is split intoYES-ETHandNO-ETHand is used as the reserve for theYES-ABCandNO-ABCbonding curves respectively. - Participants trade on the

YES-ABCandNO-ABCcurves predicting the value ofABCif the proposal is accepted on not accepted. - The decision is resolved using a normal futarchy decision function such as highest price over the last 24 hours.

- The winning bonding curve’s reserve pool is converted back into

ETHthrough the tokenized event and is used as the reserve for the mainABCbonding curve once again. The winning outcome tokens can be exchanged forABCand the mainABCbonding curve can resume trading as normal.

Drawbacks

- It doesn’t work for normal tokens that don’t have a bonding curve.

- Allowing the main bonding curve to function during a decision is an unsolved problem and may not be possible.

- Bonding curves (as well as LMSR markets) are susceptible to front running.

- New decisions may create a race to be the first to buy into the new bonding curve.