Its a little unclear what he means by “fair”, but I think the chain will be more censorship resistant if validators are spread over different regions of the world (lesser chance of > 1/3 of the validators being subject to decisions of a single government). Therefore, I believe making ethereum known in “underrepresented” parts of the world is important, even if that takes more effort than making it known in the US for example. Of course there should be a balance, but you probably get what I mean.

I don’t think that is what the cryptocurrency ecosystem is trying to achieve at all. They are trying to achieve censorship resistance, permissionlessness, and trustlessness. Decentralization is a useful tool sometimes to achieve these goals but it is not a goal itself.

Proof of Stake should be resistant to censorship even if a super majority of validators are operating under a single jurisdiction.

I’m a huge fan of getting more people in the world interested in using Ethereum, but as users not stakers. I don’t care where the stakers live, they are just a service provider to the users.

TL;DR: Solo stake if you can, don’t stake at all if you can’t.

If you give your money to a bad person and that person then does a bad thing with the money and it is confiscated, you don’t get your money back. No one should be staking with custodial pools (or really any pools). Staking is not a requirement and many people who use Ethereum don’t stake on Ethereum. The returns right now are pretty low (4.1%/year) so it doesn’t even pay particularly well.

The entire point of Proof of Stake is that anyone participating as a validator has something to lose. If we say, “well, if you are staking with other people’s money then we won’t penalize you for being a bad actor” then it just means attacks against the network become free and the entire system breaks because now people don’t actually have anything at stake.

Repeated For Emphasis: Do not stake in custodial pools! You are giving your money away and hoping the recipient doesn’t do anything bad with it and they give it back to you later. This is not guaranteed in the slightest (see history of exchange defaults/hacks/rugs).

Please let me know, if they reply. I appreciate all research/work you have done in relation to this topic.

Thank you for this explanation. it helps a lot. like you said its going to be complicated when we have DVT

Is this actually possible? If most of the validating nodes run in a single jurisdiction / sphere of influence, then surely they are subject to the authority of that jurisdiction? Can you practically resist that authority through technological means alone? I would posit that geographical dispersal of nodes is really important.

(also, and I’m sorry for being pedantic, but could we collectively stop using the word “offshore”?)

Yes, via UASF/UAHF that penalizes the attacking validators. This is the primary (IMO) reason to switch to PoS over PoW, because it transfers power from the hands of miners/validators into the hands of real users of the platform. If the validators break the rules and we can detect/attribute it (after the fact), we (Ethereum users) can penalize the attackers severely because their funds are locked up for an extended of period of time after the attack.

Note: This isn’t “technological means alone”. This is “technological + social” means, but the social means shouldn’t be too challenging as long as it is well known to all participants up front.

The nice thing about this is that as long as the threat is present and credible, it is unlikely that anyone would attack the network in this way.

No word from them unfortunately  Just bugged them again.

Just bugged them again.

Maybe someone else here might have better luck? I don’t know anyone from Miga, not sure if y’all do…

Given collateral damage, it would be the equivalent of mutually assured destruction. But confident in the worst case scenario, the community-backed protocol (aka social consensus) can likely recover.

Hah agreed. It’s very a US-centric term.

A limit to everyone being able to participate as validator (beside for personal financial interest) to increase decentralization of authority, is the affordability. With 32 ETH hard-coded as the minimum requirement, as the price continues to increase (with economic applicability) over time (never mind short-term volatility), we will see increasing centralization of participating validators, i.e. you will only see old validators staying (some may cash out and leave for retirement) and no new validator coming in. Therefore, unless the problem of affordability is resolved, we will see the need for 3rd-party custody services. Of course we can also see further need for tighter regulation to prevent fraud and misappropriation from such 3rd parties.

One solution to solving affordability that I can think of is to make the requirement affordable at least to 80% to 90% of those in working class, say, maybe a minimum requirement of 1 ETH, or even 0.5 ETH. Now we may think that’s illogical, but say that again if/when the price of ETH reaches $1 mil.

Privilege to validate transactions should scale with the amount of ETH staked. For example, if a major validator staked 1 mil of ETH (not USD), then he/she can validate transactions up to, say, 50% of its staked ETH amount, that is 500k ETH. If everything goes well, he/she earns a small “commission” of that 500k ETH. If he/she tries anything fanciful, he/she loses 1 mil of ETH.

The poor average Joe that get to stake 0.5 ETH and becomes a validator also gets to validate transactions, but so far as long as they are up to 50% of the staked ETH, or 0.25 ETH in this example.

In this situation where the minimum requirement is not hard-coded, almost everyone, including the poor, gets to be validators and enforces network decentralization.

And the protocol be such that everyday menial transactions (such as buying a cup of coffee) be relayed to validators with small stakes. In USD, say a tx to buy a cup of coffee that costs USD5 should be relayed to validators with stakes of USD10 or more. Smaller staked validators should be given top priority over gargantuan stakers. Gargantuan stakers with over 1 mil ETH, for example, can validate tx that involves 500k ETH or lower, for example.

In such structure, we can see being a smaller validator gets to benefit far more because most daily tx involves small priced items. Such tx have way much higher velocity of money. Gargantuan stakers can have institutional-level tx instead. Everyone gets a fair share of the pie, the number of validators will grow, and the network will be healthily decentralized.

As for the return of being a validator, we will leave that to the balance of economics. If the return is 4.1%/year, then validators will naturally be inclined to move out to alternative investment options that offer higher return. With lower validators, the return will readjust upward, eventually to match the returns of alternative investments, risk-adjusted. The balance of economics will resolve all imbalances by itself, naturally. There is no need to worry about the return from staking for being too low or too high. It is low/high for economic reasons.

I sent them an email too. I will let you know if they reply. Also, searching for personnel works at miga through my discord/telegram connections.

thanks for your reply here Micah. I personally think if the most validators reside in a one or few jurisdictions and they are known, its very much easier for regulator to force the law, regulators can hold entities directly liable for not complying with law. at this point they will adhere to them over going to jail. It is hard to think that slashing will work on this point.

if we play out UASF/UAHF penalty impact:

Validator comply with sanctions laws and remove transactions submitted to certain wallet address => Ethereum users penalize validators for breaking rules => Validators loose economic incentives => Validators then have to assess risk vs return => Validators opt out being one=> validator count reduce (over 30%)

If everyone is staking from home the POS will be much more censorship resistant even if a super majority is in the same jurisdiction (although I still feel more comfortable having validators spread out if regulations are harsh enough).

But I’m also not sure if you are saying that even if a super majority of validators are controlled by only a few regulated entities residing in the same jurisdiction POS should still be censorship resistant because of the possibility of slashing them through a hard fork.

This is exactly what I’m saying. While not having all of the validators in one jurisdiction is better than having them all in one jurisdiction, it isn’t critical that the validators are spread out across jurisdictions.

The 32 ETH is set largely for technical reasons because if there are too many validators we start to run into bloat problems. It wasn’t set to 32 ETH because anyone wanted to keep small validators out.

We have way more validators than we need right now. Having 30% exit would not be problematic. Even if 90% exited, we would still be fine. Total validator count would slowly decline over time (it takes a long time to drain 90%) and the yield would increase over time incentivizing new validators to come in.

- I believe whatever the bloat problem is by having too many validator, is an imaginary problem. Understand that people stake for investment return. If there are too many validators to the point where the return from staking is, say, 1%/year vs an alternative investment that return, say, 7%/year, risk-adjusted, then existing validators would unstake and leave the network for better options elsewhere, thus solving the bloat problem. The return from staking vs the return from elsewhere will cap the number of validators, optimally. The reason why you see too many validators now is mainly because everyone wants to get a piece of the pie while nobody can get out. Once everyone can unstake and get out, you should not see the problem of having too many validators.

- Assuming if ETH reaches USD1 mil with total validator count that is extremely low to the point where the return (or yield) is super attractive relative to everything else, with ETH being priced at USD1 mil, it will only incentivize rich validators to come in. New and poor validators will never afford to join. Over time, the number of validators will shrink, or centralized.

- With 32 ETH hard-coded, we can never avoid the small guys from seeking out the services of 3rd-party custodians.

Edit:

4. And like I said it before, if 32 ETH being the minimum is unavoidable, then having 3rd-party custodial service providers will also be unavoidable, and thus the only way out is to have stricter regulation that oversee the conducts of such 3rd-party providers from fraud and misappropriation. And unfortunately, such providers may also comply to centralization, including the need to sanction transactions as required by the government.

The purpose of staking is not to create wealth equality, it is to secure Ethereum. I think everyone would like to lower the amount, but we first would need to solve the bloat problem caused by having too many validators. Until such time as it can be lowered, the value unfortunately needs to be high. I’m not an expert on this area so I can’t speak to the exact constraints but I am confident in the people working on PoS are doing what they can to set the value as low as is sustainable.

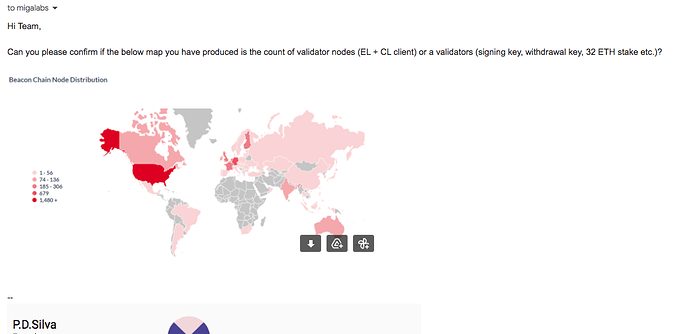

Miga Labs was kind enough to respond! Please see below for their feedback:

The set of nodes that we display in that graph corresponds to the total number of Ethereum CL Beacon-Nodes that we can discover and connect from the p2p network. There is no way to know whether a Beacon-Node hosts consensus validators or not, so we just get stick to the Beacon-Nodes. About how do we get the geographical distribution, yes, you are right! We identify the countries and cities based on the public IPs that nodes advertise.