Growdrop:Funding the revolution of blockchain ecosystem

Problem

Blockchain financing method is not a structure in which everyone can invest equally. Crypto-fund or angel investors have a better SAFT or indiscriminate EXIT, which is why the average investors know and are deceived. In addition, the fraud token economy is formed by the unfounded projects preparing for the ICO in a token-free structure, where users buy tokens and have no effect on the crypto network.

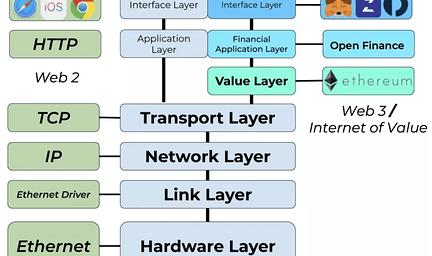

Blockchain and Community

Blockchains have their values formed in the protocol layer, unlike values that come from the application layer of the past internet industry. The value we talked about comes not just from the value of cryptocurrency, but from the birth of Bitcoin and Ethereum as a support of many communities. The value of the community provides a way to fork in the evolution of blockchain or to go forward through governance proposals. This process forms the core of the blockchain, the consensus value, which enables the sustainable development of protocols in accordance with reasonable governance rules for many people in the community. At some point, consensus value made a way to raise the value of instant community participants (speculators) through the funding method of ICO and IEO. This speculative bubble is extinguished for a moment. Enthusiastic supporters gave a lot of feedback through BIP and EIP to form the initial consensus value, while the speculative bubble is blowing and the supporters of the blockchain project are concentrated only on pump and dump. This means that the blockchain protocol stays thin before fat, and even the application layer (EX: Dapp) will not inherit its stability and decentralized value. That’s why Bitcoin, whose consensus value is fat, is not the first cryptocurrency in history, but the most successful case. The mechanism designed by Satoshi Nakamoto allows the Bitcoin community to achieve effective self-organization and governance, which motivates community members to continue to benefit from mutual benefits.

Open source community funding

Currently, in the case of fat Ethereum, compared to other blockchain protocols, there are about 20 to 30 true contributors to development. There are many factors to this problem, but the open source community lacks the motivation to maintain the ecosystem voluntarily. Therefore, various methods of financing are proposed to protect investors and supporters in the current industry. From the DAICO proposed by Ethereum founder Vitalik Buterin, there are Inflation Funding, Gitcoin, SEICO, Ensured ICO. Equivalent token distribution methods include Lock Drop, Livepeer, WorkLock.

Growdrop

What we think so far is that the cost of trust in financing is very high. It is expensive and pays a lot of money for maintenance of all kinds of unnecessary surveillance systems. Growdrop is a crowdfunding solution that guarantees the principal and deposits funds into the liquidity pool of Lending Protocol by minimizing the trust costs of existing third parties.

Growdrop’s Mechanism

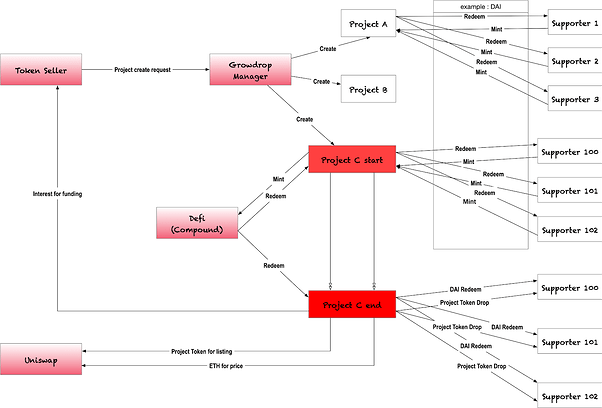

Given that Growdrop allows third parties to securely operate smart contracts, Growdrop can invest in projects, greatly reduce the risk of supporters’ seed investments, and projects will slowly build communities to help promote public relations and technology development. Here, in the early Ethereum community, it is very similar to the nature of DAICO, and projects can start as a community and receive seed investment and promotion effects. Here’s how Growdrop works.

• Token projects will deploy their Growdrop’s smart contracts. Then a Growdrop pool is created, allowing you to send crypto assets. In the smart contract, funding period / token quantity should be entered.

• Interest earned from crypto assets sent by supporters to the Growdrop pool will be sent to the token project at the end of the funding period.

• After funding, tokens in the smart contract are sent to the supporter according to the supporter interest.

• (Optional) Token projects can create exchanges and add liquidity pool to uniswap by setting certain tokens and interests after Growdrop funding ends. The project’s token will be deposited in the uniswap liquidity pool after Growdrop funding is completed, creating an environment where traders can trade with supporters before or after listing on a centralized exchange, and value will be formed by supporters. If adding liquidity pool fails, all remained tokens and interests go to the token project.

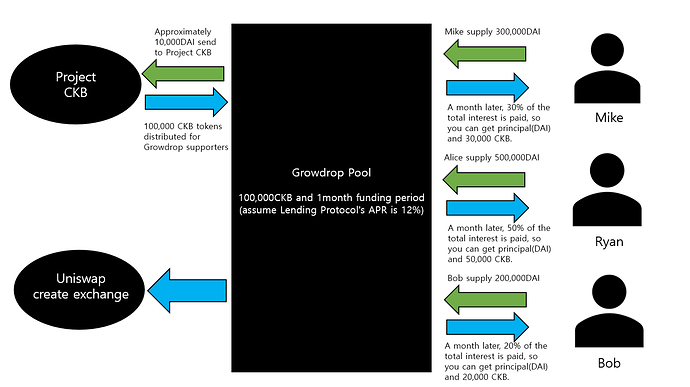

Example: Mike, Ryan, and Bob can stake a crypto asset on a project called CKB to offer interest and receive CKB tokens in return. The CKB project sets a token amount of 100,000 CKB and one month of funding period when Growdrop distributes smart contracts. Mike sends 300,000 DAI, Ryan sends 500,000 DAI, Bob sends 200,000 DAI to the Growdrop pool, and assumes that the Lending Protocol’s annual interest rate is 12% at that time. After one month of funding period, the accumulated interest is sent to the CKB project and CKB tokens are paid to the supporter according to interest rate.

Uniswap

If the initial token project is not listed or there is no use, the token from Growdrop can be added to uniswap to set the listing and price. You can create exchange contract and add liquidity pool for a certain amount of tokens and interest. Here’s how to provide Growdrop.

-

The Growdrop Distributor sets a certain amount of tokens and interest rate for the uniswap.

-

At the end of the Growdrop funding period, swap the interest calculated by interest rate to ETH by uniswap exchange contract.

-

List the swapped ETH and tokens to uniswap.

Listed ETH / Tokens are priced according to the size of the pool, Growdrop’s supporters can make exchange or add pool by putting the funded tokens and ETH into the liquidity pool.

Limitation of Growdrop

• The DeFi ecosystem is still in its infancy and there are risks that can have a big impact.

• Because we contribute to the project with interest, the heart of Growdrop is a model that depends on funding scale.

• Due to the current Lending Protocol, interest volatility can be very high.

Difference from other Interest rate donate projects

• Interest rate donate models must bring in a lot of money to generate a lot of interest. In the case of PIP, the price per token is fixed and the token is issued according to the amount of interest generated. There is no limit on the number of token issuances here, and the tokens of the project can be issued indefinitely. As a result, if the supply continues to increase in the secondary market, the corresponding token market will collapse. This has a significant limitation on the token economy of the project. The Growdrop model has no token price and lockup period, and the project can flexibly set the number of tokens to proceed with the existing token economy plan. Supporters can make deposits and withdrawals autonomously depending on the project situation.

Conclusion

Since DeFi’s market is still a new market, there are risks that can cause side effects from interest volatility, and it is still active only in the Ethereum ecosystem. Through Growdrop open source projects can get seed funding and form a community culture with supporters who are naturally valued rather than very expensive financing such as ICO and IEO. Growdrop is a new funding model. This makes Growdrop a new option for contributing to open source projects and breaking the vicious circle of financing.

Github:https://github.com/bannplayer/Growdrop/tree/master

Reference:

EIP1789:https://github.com/ethereum/EIPs/issues/1789

Funding the Evolution of Blockchains: https://medium.com/@FEhrsam/funding-the-evolution-of-blockchains-87d160988481

*Please give us feedback as it is a new defi model !!