We propose an alternative to token models where token burning is the default value capture mechanism. We aim to show that networks in their growth phases do not need to choose between capturing value and further developing the network. These two seemingly opposing choices can be brought into alignment.

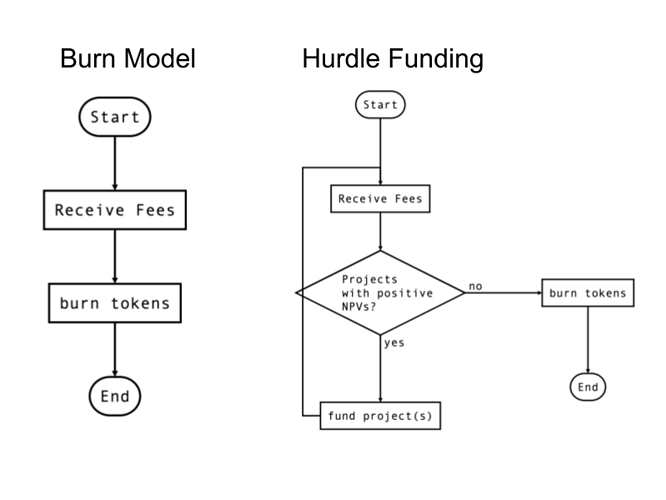

In the token burning model fees that are received are used to remove the token from supply usually by sending the token to an irretrievable address (burn address). If the fees are received in another token the native token would be acquired first then sent to the burn address. Both variants are methods of returning capital to token holders, leaving the onus of how to deploy that capital to the individual token holder.

Hurdle funding at a high level adds a filter prior to burning. If there are projects that could deliver value back to the network above their cost those projects are funded. In the case there are no such projects then the best path is to return capital and allow the individual token holders to find a better use for it.

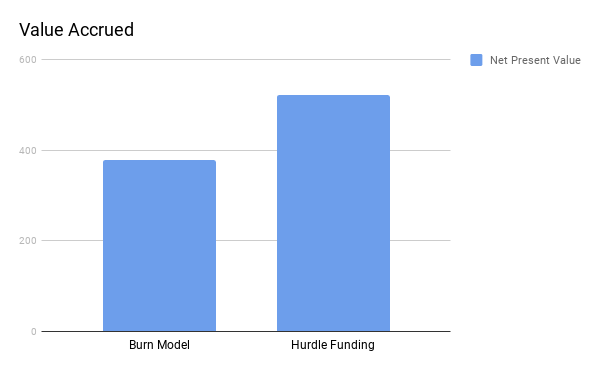

While burning tokens does accrue value to the underlying protocol we believe this being the default action will accrue less value to underlying protocols in their development and growth phases. Below we will show how networks that invest in positive expected value projects will accrue more value than burning by default. Conversely, networks that are approaching the end of their useful lives and have few or no positive expected value projects would be better off burning.

Example

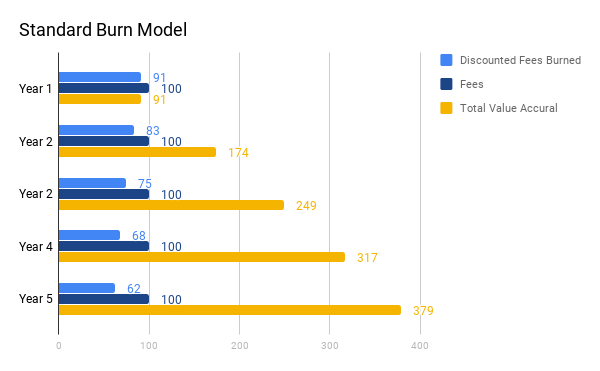

Let’s start with a protocol that receives $100 equivalent in fees per year for 5 years. The protocol uses the fees to burn it’s token the same year as the received fees. In year five this leads to a net present value accrual of $379 equivalent to the protocol.

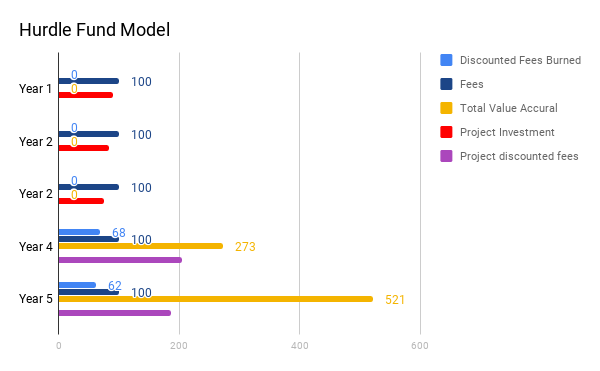

In the hurdle fund model we first check to see if there are any projects that have discounted value accruals which are greater than the initial investment. We find a project which requires an outlay of $100 equivalent for the first 3 years giving us a discounted cost of $249. The project produces its own value flows of $300 per year for two years starting in year 4. Giving the new project fees of $391 for a net present value of $142 which is the additional value contributed over the burn model.

Tying up Loose Ends

Hurdle funding does add the additional risk of funding projects which contribute less value then their initial investment. If our project only returns $175 per year in the last two years we will have a Net Present Value (NPV) of -$20 giving us a final value accrual of $359, which is less than if we had just burned.

Knowing that each project could fail to deliver a positive NPV, we should account for this in project selection. In order to do this we can take a project’s probability of failure and multiply the expected value flow by its complement, the probability of success, which we then subtract from our initial investment to see if the risk adjusted returns are positive.

Let us add in the probability of failure for each project. For simplicity let us assume we have 10 projects to select from and they all have a 90% probability of failure. We also assume they all require the same initial investment and have the same expected value flows. In this example we make 10 investments and only one produces any kind of value flows. If we allocated $30 to each in the first 3 years we would have allocated the full $300 in fees. In order to get back to the same expected value contribution each project is now expected to produce the value flows as the original project but with only an investment of $30, however we are not factoring in a 90% probability of failure so the expected NPV of each project is ($391 * (1 - .90)) - $24.9 = $14.2. Given that we have 10 projects the expected total accretive NPV is $142 over what a pure token burn model would produce.

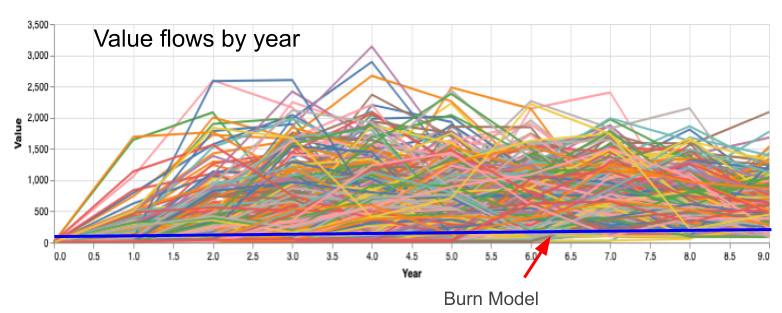

Simulation

We created a simulation in which a project receiving $100 in fees for 10 years invests in positive expected value projects. Running this experiment 500 times we found that the mean hurdle fund NPV was $2,323 while the burn approach was $675. Only 3 observations (~1%) had NPVs below the burn approach with a mean of $447 or ~34% below the burn approach. In other words, hurdle funding produced higher NPVs 99% of the time.

Simulation notebook: Hurdle Funding simulation / Barry G | Observable

Further Exploration

While it’s beyond our immediate focus here to propose robust ways of estimating the value flows of projects, we would like to propose areas that look promising. There are studies showing that crowdsourced estimates do provide useful information in markets1. Protocols like Numerai have found that adding staking to crowdsourced estimates further improves the estimates2. Doing project selection and valuation in a decentralized manner is likely a much harder problem but a skin in the game approach such as futarchy might enable sufficiently good project selection to still be an improvement over burning.

1 Jame, Russell and Johnston, Rick M. and Markov, Stanimir and Wolfe, Michael, The Value of Crowdsourced Earnings Forecasts (March 23, 2016). Available at SSRN: https://ssrn.com/abstract=2333671 or [http://dx.doi.org/10.2139/ssrn.2333671](https://dx.doi.org/10.2139/ssrn.2333671)

2 “We analyzed the Sharpe ratio of the unstaked models vs the staked models based on the backtest of the test set. Here is the performance:

Sharpe ratio of unstaked models: 1.66

Sharpe ratio of models staked with NMR: 2.09 “ - https://medium.com/numerai/numeraire-the-cryptocurrency-powering-the-world-hedge-fund-5674b7dd73fe