Is it worth using MEV-Boost?

To answer that question from an economic perspective, we will look into the APYs.

> For simplicity, we assume a total of 1 million active validators and ignore sync-committee rewards.

> The underlying data ranges from November 2023 - 6 June 2024 and includes all slots.

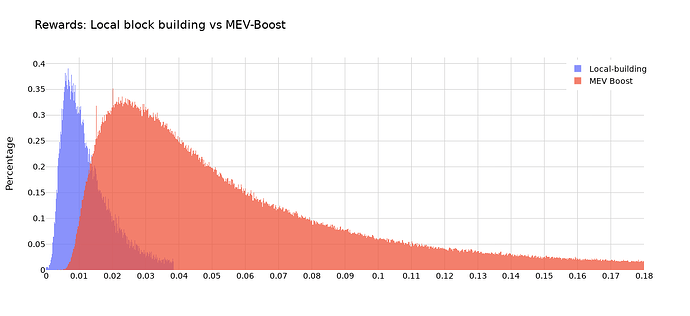

First, let’s check the difference between local block building and using MEV-Boost.

We can see that the block reward is higher for MEV-Boost users:

The median block reward increases from 0.0076 to 0.0380 ETH (400% more).

What does that mean on an annual basis?

The statistical 2.6 blocks a validator gets to propose per year yield a total of 0.0199 ETH in block rewards.

For MEV-Boost blocks, the 2.6 blocks yield a total of 0.0998 ETH per year.

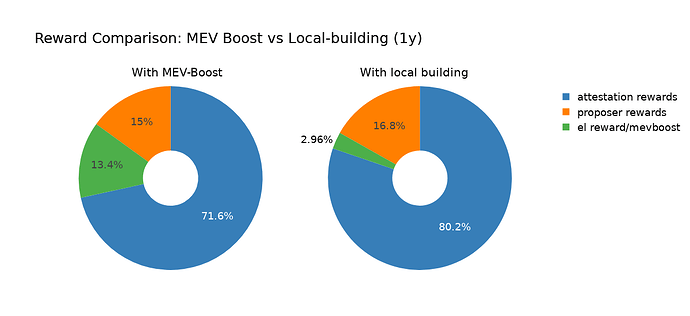

When shown in a pie chart, we can see that the share of the block reward (green) grows from 2.96% to 13.4%, compared to the total expected rewards per year.

What does that mean for the APY?

For validators not using MEV-Boost, the expected annual revenue is 0.929 ETH.

For validators using MEV-Boost, the expected annual revenue is 1.009 ETH.

These are additional ~8.6% of revenue.

Using MEV-Boost increases the APR from 2.93% to 3.24%.

For the APY (compounding every epoch):

\text{APY}_{local\ builder} = \left(1 + \frac{\text{APR}}{n} \right)^n - 1 = \left(1 + \frac{\text{0.0297}}{365 \times 225} \right)^{365 \times 225} - 1 = 2.97\%

\text{APY}_{mevboost} = \left(1 + \frac{\text{APR}}{n} \right)^n - 1 = \left(1 + \frac{\text{0.0324}}{365 \times 225} \right)^{365 \times 225} - 1 = 3.29\%

Finally, using MEV-Boost increases the APY from 2.97% to 3.29%.

Find the code used for this analysis here.