The biggest issue of tempered issuance and other issuance curves that flatten out after certain stake rate is that they result in a big gap between the stake rates at which solo stakers become economically disincentivized and where LSTs do so. This creates a large regime of stake rates where solo stakers get pushed out of the validator set, while large operators and LSTs remain viable.

To show it more explicitly I have prepared a couple of plots of tempered issuance. But all other issuance curve variants that taper out slowly suffer the same fate.

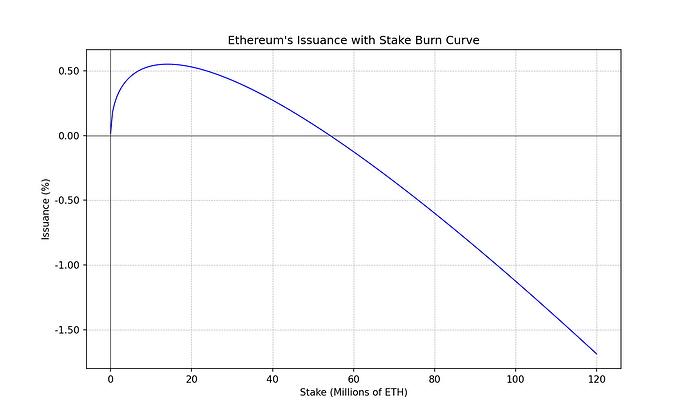

First let me show the issuance curve I’m using. It’s tempered issuance with the pre-factors of c and F set to their current values (2.6 and 64).

The following plot shows the real yield. With real yield I mean issuance yield observed after costs and net of circulating supply changes.

As you can see, home validators become uneconomical around 60M ETH staked. But holding an LST is still economically viable until well over 110M ETH staked. To be more concrete, when a validator crosses the zero line it means that after costs he is earning ETH at a slower rate than the circulating supply inflates.

The issue is that if we ever cross 60M staked ETH, solo validators will progressively become pushed out of the validator set. Either because they unplug the machines seeing after costs they can’t even outrun inflation or slowly, because centralized operator are still economical and gaining a greater share of the pie.

Perhaps a bit unintuitively, the hard cap issuance curves protect solo validators better. If the issuance curve tapers down sufficiently aggressive, all types of validators cross the 0 line sufficiently close.

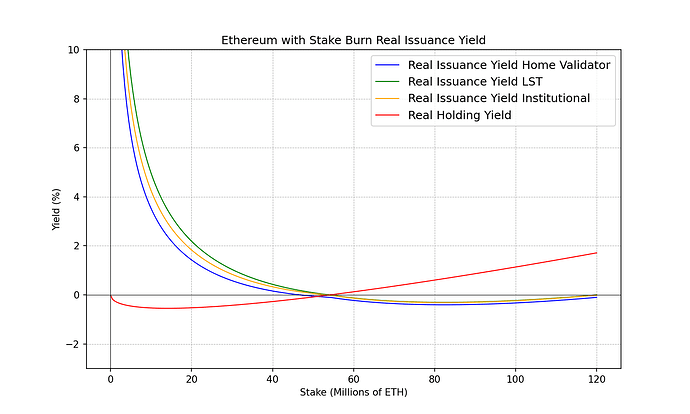

The following is an example of such an issuance curve, just to exemplify the effect I refer to:

And here the real yield (net of costs and circulating supply changes):

As you can see the gap between home stakers and LST holders can be made quite small. This helps protect solo stakers because they remain economically viable until pretty much the same stake rate.

I would argue we should go for the hard cap issuance curves. Coupled with uncorrelation incentives that help buff up uncorrelated validators.

For more details about how I calculate the real yield of different types of validators check here: The Shape of Issuance Curves to Come