Public Interest Projects - A Fully Onchain, Risk Minimized Seed Funding Mechanism

This post is a summary of the Public Interest Project. If you’d like to read the full paper, please click here. The full paper goes into more detail on the state of the ICO and IEO markets, the shortcomings of the ICO and IEO, the customization of PIPs, and gives more depth overall on this topic. We recommend reading it for the extra context. (Also, as this is my first post, I will unfortunately have to remove hyperlinks in this post as I am restricted to only two - the full paper has all the links included.)

Introduction

As ICOs grew in popularity during the 2017 crypto bull market, the structural problems of ICOs were magnified and abused. The main criticism of ICOs is that funds are received in one lump sum. This makes it convenient for scams to occur and removes the concept of milestone-based funding. In traditional financing, teams raise small seed funds and then raise larger funds through Series A, B, C and so on. Subsequent fundraises only occur if teams achieve milestones and build investor confidence. With the popularization of ICOs, the concept of seed rounds for crypto projects financed by crypto participants have been largely overlooked.

The Public Interest Project (PIP) is a fully onchain seed funding mechanism which solves the many issues with ICOs while removing the risk of losing the patron’s principal, assuming the smart contract is correctly built.

How it Works

PIPs fund projects in a way that, assuming the PIP smart contracts are secure, are risk free to the patron. This is an extremely beneficial property of PIPs given that the risk of losing invested capital is highest during the earliest phases of a project, such as a seed round. If the team proves themselves to the crypto community during the PIP phase, they can choose to conduct a follow on funding via a DAICO. (Contributors to PIPs will be referred to as patrons because it is important to make the distinction that patrons are not investors.)

The PIP is simply an addition to ideas already being discussed and implemented in the crypto community such as by PoolTogether, ZeframLou, PaulRBerg, rDai, and probably many others out there who have similar ideas. (The full paper has links to each of these people/projects)

Below is a simplified explanation of how the PIP works. At the end of this section is a link to the github repository which has the technical explanation and diagrams. Simplified version:

- A token project deploys a smart contract which interacts with the Compound protocol. Patrons can then send assets to the smart contract.

- The interest yielded from the patrons’ assets in the smart contract are then sent to the token project, creating a stream of interest funding for the token project.

- The smart contract will send back an equivalent amount of the project’s native token to the patron based on the interested yielded from that individual patron’s staked assets.

- The token project (or anyone else) could create a market on Uniswap for the token to create a pool of liquidity for patrons to trade with. This price discovery would result in a market rate for the token to derive the amount of tokens necessary to send back to the PIP patrons.

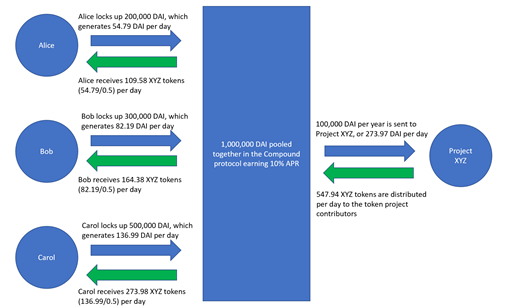

To help tie the PIP mechanism together, let’s go through a simple example. Alice, Bob, and Carol decide to pool their assets to fund Project XYZ and in return will receive XYZ tokens. Alice sends 200,000 DAI, Bob sends 300,000 DAI, and Carol sends 500,000 DAI for a total of 1,000,000 DAI in the PIP smart contract. In this example, assume that the interest rate (APR) is 10%. For simplicity, assume that the interest is paid daily and the project’s tokens are returned daily. Finally, assume the price of XYZ token is equivalent to $0.5 USD and that DAI is equivalent to $1.00 USD. The diagram below shows how this would play out.

The technical explanation of how PIPs work can be found in this github repository. This repository also contains example smart contracts. These example smart contracts are not audited and are simply meant to help others get started quickly. These should NOT be used without further due diligence.

PIP Seed Funding Benefits and Limitations

The PIP solves many of the problems that ICOs have been criticized for. Assuming the PIP smart contracts are working as intended and that the price of DAI remains at $1 USD, the benefits of PIPs are:

- PIPs are a way for token projects to access seed funding fully onchain. If the project proves itself and builds investor confidence, it can choose to do a follow on round through a DAICO. This will help filter projects more effectively.

- Typically, the earlier that funding occurs, the riskier it is. The PIP removes the risk from seed round financing because funds are only sent via interest on the patron’s capital. The patron only “loses” out on the opportunity cost of having invested that capital elsewhere. To compensate for this, the patron receives tokens from the token project equivalent to the interested gifted.

- PIPs essentially introduce milestone based funding to crypto financing because patrons can remove or add more assets to the PIP contract depending on their assessment of the project’s development. This should create more motivation for teams to continue to build versus the lump sum model of ICOs.

- PIPs reopen funding opportunity to all who wish to participate because this is done entirely on the Ethereum blockchain, without reliance on outside entities.

- Projects funded through PIPs are not dependent upon centralized exchanges to provide liquidity. Projects can simply create their own Uniswap market from the beginning if they want.

Although PIPs carry many benefits, there are also limitations and unknowns which are:

- Since funding is sent as interest yielded from staked assets, the amount of funding a project receives may not reach very high amounts. Given that PIPs are meant to address the lack of seed funding mechanisms in the crypto market, the lower fund size is to be expected.

- If PIPs as a fundraising mechanism were to grow rapidly, it would introduce a large influx of loans supplied to the Compound protocol. All else equal, this would push the interest rates down for these assets. There may be a ceiling in the short term on how many projects could simultaneously run large PIPs.

- If interest rates dropped drastically, it would create strain for the projects funded through a PIP. However, this does not differ much when compared to projects funded through Ether or other cryptos, which have declined drastically in price since the peak of the previous bull market. As always, responsible capital management is essential.

- The DeFi ecosystem is relatively brand new. There are still a lot of unknowns that could create unforeseen side effects from an influx of loan supply.

Closing Thoughts

The bull market of 2017 created a massive spike in popularity of ICOs. Although ICOs have helped enable innovation for the crypto industry, the structural flaws of the ICO have been abused by scammers, have rewarded teams without any milestone structure, and have unfortunately led to many investors losing funds.

PIPs act as a seed round for crypto projects to get off the ground. Through this process, teams can prove themselves to the broader crypto community before taking on further funding. PIPs, assuming the smart contracts work as intended, remove the risk of losing patrons’ capital since funds are contributed through interest yielded on the staked capital. Although the patron will lose out on opportunity cost, the patron will receive tokens in return for the interested gifted to the team.

The PIP is an example of how the crypto ecosystem can self-regulate and self-correct and move together towards more responsible mechanisms. Hopefully the PIP can serve as a seed funding option to help further the innovation of the crypto ecosystem at large while protecting patrons’ capital.