The cryptocurrency market has evolved greatly in recent years. However, it is still at an early stage in relation to other financial markets. While some derivative instruments exist, in the next stage of development more appropriate derivative instruments are required. A similar progression has taken place in other financial markets such as precious metals, hydrocarbons, metals, stocks, currencies, and so on. The cryptocurrency market is waiting for derivatives correctly implemented for its specificity.

At the heart of the problem is the high level of volatility, as well as, other factors described in the article. For these reasons, it is quite difficult to create a highly liquid and properly operating market for derivatives on Bitcoin and other cryptocurrencies. In order to hedge or simply speculate on rising or falling prices, option sellers are required. However, due to the specifics of the existing market, and factors outlined in the above-mentioned article, at certain times there are no such sellers. Even if sellers do exist, they require extremely high premiums eliminating any reason to buy those options.

Our company has developed a method in which the participation of sellers is not required. We also developed a working model of this method in the form of a visual tool. We started from a model that’s used today in sports betting, called parimutuel betting. In essence, all bets go into a pool and then distributed amongst the winners after the event in question takes place. However, this method has limitations for use in the financial markets. The amount of potential gain is unknown in advance. This is a problem because in order to hedge or sell short, a trader needs to know in advance what the amount that he or she will receive when the underlying asset hits a certain price in the future.

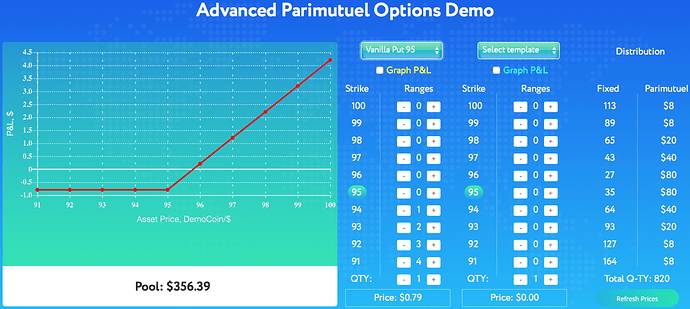

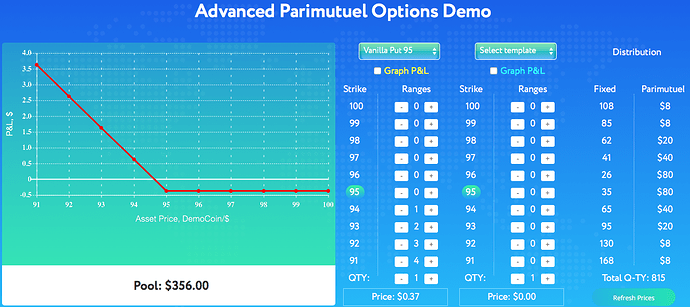

We created a method opposite to that of parimutuel betting and called it reverse parimutuel — a method in which an option premium is variable, but is always the best possible price and is the same price for all participants. Because the price of the premium is known in advance, the gain relative to the price of the underlying asset can be calculated. The premiums for our options consist of the price of one or more of so-called ranges, which are the building blocks of our options.

To solve the problem of determining a single premium for all participants for the same basic contract, we adopted an auction model. During the auction on the APO platform, all participants submit market or limit orders, just as they would in the familiar centralized exchanges. At the end of the auction, the algorithm calculates prices for the base states (ranges), and then calculates prices for all options that have bids. This process is shown in the demo of the algorithm on our website. The APO platform differs from the standard centralized exchanges in that its operation does not require sellers and payments from the collective pool are guaranteed to the winning bidders.

(for ex. Call 95)

(for ex. Put 95)

In addition, the system has the capacity to handle all kinds of different options in the same pool — from classic calls and puts to sophisticated option constructs of any complexity. By participating today in the creation of such a tool, you can be at the forefront of a fundamental change in the derivatives market, as well as in the cryptocurrency market.

You can read more details in the article.

And you can try the Demo in our website.

Video on YouTube here.