I am writing this because I learned of governance challenge that Ethereum is facing. However I am not aware of the latest progress but I would like to give some of my opinion on the issue with the hope that may help provide some valuable insight in solving or improving it.

Disclaimer: I am not a highly trained technical person, so in case of misunderstanding, then please pardon me.

The idea of a staker (or whoever that can influence change either by holding/staking ETH) receiving lower governance power as a result of having higher ETH at stake is very good to reduce concentration of power, but this is still not good enough because the next best thing to exploit this is to create multiple proxies with much smaller ETH at stake and this will have much higher governance power collectively.

So how then can we possibly stop such exploitation?

I believe one structural problem (that gives rise to the opportunity to exploit) is having a single category of governing participant (i.e. as long as you are an ETH holder/staker, you can participate in governance), thus an entity can accumulate as much as possible (and use multiple proxies) to affect influence, where the limit to such influence is 100%, i.e. total centralization.

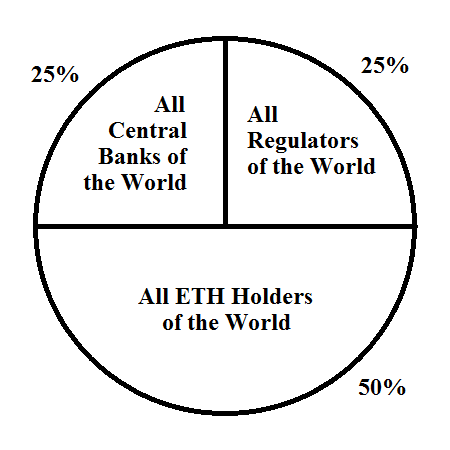

Now what if we employ 3 categories of governing participants instead of 1, as shown in the picture below?

1st category reserved to all participating central banks of the world, with governance power limited up to 25% max.

2nd category reserved to all the regulators of the world, with governance power limited up to 25% max.

3rd category reserved to everyone that holds/stakes ETH, with governance power limited up to 50% max.

The ratio is set at 25:25:50 (not 33:33:33) to ensure that in case all the central banks and regulators collude, their influence will max out at 50%.

Similarly, in case large ETH holders/stakers collude to affect governance, their influence will be limited to 50% max.

The only time a proposal will be passed is when such proposal benefits > 50% of everyone, much like a scenario whereby one person cuts a cake in half while another person takes his pick of the sliced cake, which ensures the cake will always be equitably sliced and beneficial for all.

Governments are excluded and have no governance power because governments are extremely political in nature and subject to change/restructure.

Third-parties, including enterprises and corporations are excluded and have no governance power because such entities have vested interests only in their own coins/tokens/equities.

And granting such coins/tokens/equities governance power will be extremely high risk as the issuing entities can manipulate their coins/tokens/equities significantly upward (price-wise) to have substantial financial value leading to substantial influence on governance, in addition to misalignment of interests against those that hold no such third-party coins/tokens/equities.

Bear in mind central banks and regulators need to hold/stake ETH too, and registered as central bank/regulator governing participants.

My rationale for such governance model:

While decentralization is the current hype, a society left on its own without any central authority to enforce law and order will eventually proceed to turn against itself from within.

And even if there is a “central authority” ruled by optimized computer codes and algorithms, and such programmings can be changed by a majority, then such majority power can surely be acquired by whatever means necessary for selfish gains (in case of lower gain as majority, then just use multiple proxies).

While we the people may have asymmetric power because we are many and free and we can stand up against government tyranny, we must also need to realize the source of government tyranny is not some extraterrestrial reptilian species ruling over us, but rather it is our inherently corrupt hearts that collectively manifest tyranny at governmental level.

Even in an alternate future without government, there will still be corruption, tyranny, exploitation, collusion, etc, in one form or another.

Thus I think the best governance model is not about getting rid of any particular institution for whatever the reason, but to be all-inclusive so that there will be proper check and balance in place to prevent systemic abuses/exploits and ensure higher sustainability.

There will surely be a lot of people that will disagree on having central banks and regulators as participants in governance, but the same people that disagree on this are no better off themselves and may extremely likely to commit financial crimes whenever the opportunity arises.

And we can actually see such hypocritical behavior extremely frequently from time to time whereby someone would talk/preach about decentralization, freedom of this and that, cheerleader of high moral and ethics, etc only to be caught participating in scams, frauds, crimes, lies, manipulation, collusion, etc themselves.

Absolute power corrupts absolutely, and we are all humans, not angels.

And as money can buy power, thus money shares similar effect.

I do not believe that we can totally eliminate centralization of power nor do I believe it is a good thing to be fully decentralized, as both centralization and decentralization have their own facets of good and bad (nothing in this world is 100% good nor 100% bad).

Without centralization of power in a good way, there would be no law and order.

We cannot expect the social community to police itself accordingly in a proper decentralized manner, because whenever money is involved (incl. sex and power), every man is for himself.

And full decentralization is literally impossible when the opportunity and right to accumulate (whether it be money or power) is available to everyone, thus a decentralized system will most likely to eventually evolve into a centralized system, given long enough time horizon (such time horizon may in fact be way much shorter than imagined).

And we have a choice to choose whether we want another centralized system that perpetuates tyranny, or a well-balanced system where both centralization and decentralization working together as one.

I believe a highly resilient and sustainable network should be all-inclusive for check and balance.

With a proper check and balance in place, not only will law and order be maintained, proper governance and consensus can also be enforced while aligning everyone’s general interest at the same time within a shared network.

Proper check and balance is possible because the network is all-inclusive while restricting centralization of power to any single/group of entities.

Law and order is maintained because of central banks and regulators as governing participants (do not forget the remaining 50% governing participants are we the people).

Proper governance and consensus can be enforced because all-inclusiveness allows everyone to participate for the best of the whole, without exerting majority power.

Aligning general interests within a shared network is possible because everyone shares the same Ethereum protocol, the same ETH medium of transfer, the same Ethereum governance system, etc.