IMHO the Example C looks pretty attractive, both in terms of the rewards (really high) and the inflation (still pretty low)…

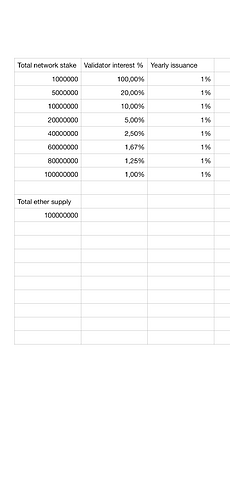

This is with a fixed 1% yearly inflation, which is easier and looks more attractive imo. I would suggest inflating on a fixed 100 mil and not on total supply, to prevent runaway inflation after xx years. In simple terms: create 1 mil ether every year to reward validators. Inflation will keep going down this way and will only be 1% in year 1, and end up being less and less (0.5% after 100 years as supply will be approx 200 mil then).

Example C brings the economics more in line with the interest of competing networks - attracting larger players now willing to build services around their spread - would also bring in existing validators with professional experience that in theory are more reliable. On the retail side the interest now exceeds other ethereum based defi products. - Something between B and C could be the sweet spot - 8.5% at 10MM Eth

I think everything @collinjmyers wrote makes sense.

I think it’s critically important to attract that “critical mass” of validators, and what better offer we can give them than high rewards?

Once the system stabilizes and we learn where the equilibrium sits, we can always further reduce the inflation if needed/possible.

I think it is also very important that the initial inflation is high enough so that we can credibly say that we should/will not ever need to increase it in the future as it would set a precedent regarding ether’s store of value properties. I know a lot of people here do no support the whole SoV narrative but I believe a credible monetary policy is essential, fixed supply/inflation or not.

@econoar would you be able to run the same simulations but with a column showing the % of total ETH participating in validating?

I’m was not especially pro SoV narrative before, but then @econoar made an important point and I changed my mind:

That said, your suggestion is in line with mine, I also think it’s better to set it reasonably high (especially because even that “high” still means <1%), and then hopefully reduce it in future. FWIW, that future reduction should have some positive psychological effect on the price (just like increasing the inflation would probably have negative).

On the withdrawal lock-up period, a question:

My understanding is that I can keep my stake staking for as long as I want until which time I request to withdraw it.

Will I have some way to know at the time I request or be able to track how long it will be before my stake is released?

Can you withdraw partial stake or do you have to withdraw it all?

The problem with fixed inflation is that it risks making certain kinds of attacks more easily profitable, see research/papers/discouragement/discouragement.pdf at 3aa84a76dd7cf4a003876d2766ab4aa1726f2622 · ethereum/research · GitHub

Can you withdraw partial stake or do you have to withdraw it all?

Withdrawing validator slots is all-or-nothing. But if you have multiple validator slots, there is nothing linking them to each other…

The risk of lack of participation in the early days is more detrimental than a high inflation rate IMO

I see two reasons for not setting inflation too high from the beginning. First, we’ll likely have a hard time adjusting it back down in the future. It’s unrealistic to expect stakers to vote against their own best interests and lower inflation “for the good of the network” when doing so is entirely voluntary. Yes, we’ve successfully reduced mining rewards in the past, but we relied on the community’s pre-commitment to PoS as a justification for steadily reducing PoW mining rewards. We won’t have such a convenient justification going forward.

Second, if the ratio between inflation rewards and transaction fee rewards are too far off, it encourages perverse incentives from the stakers. Assuming the transaction fee market doesn’t change under PoS, let’s use 500 Ether as the median transaction fees paid per day. Multiplied by 365, that means stakers earn 182500 Ether total, making it a 1.83% return assuming 10M staked Ether.

In @econoar 's Example C, inflation rewards more than 5x transaction fees. As a rational actor, stakers have a much greater incentive to keep the total staked amount low rather than increase the usage of the network. To illustrate, imagine we quadruple the transactions fees paid and double the amount of people staking. Transaction fees now return 3.65% from 1.83%, and we’ve doubled the “protection” in terms amount staked. However, stakers actually lose out 1.18% return in total since the inflation reward goes down from 10.15% to 7.17%.

As a result, at high inflation amounts, stakers could be incentivized to minimize the amount of other stakers at all costs, even if it results in less usage of the network. Price fundamentals of ETH would also largely track the amount of people staking, not network usage. It’s worth more if fewer people stake given the returns you can get, and it’s worth less if more people stake. This behavior is contradictory to the design goals of Ethereum, which seeks to align incentives with increasing network usage and increasing economic value in each transaction.

As an aside, I don’t believe we should treat staking participation as strictly an economics problem (e.g. how much inflation should we allow to give us a necessary return). After all, the biggest holders of Ether likely are people with a big stake in the success of crypto (exchanges, whales like Novogratz, etc.). They’re not diversified between asset classes in such a way that they could shrug off the failure of an ecosystem as big as Ethereum. Based on my experiences with the community, it’s also not unreasonable to expect that many existing community members will stake just to support the network in the short run.

Therefore, practically speaking, I believe the issue of staking participation is as much a question of community organization and rallying to get stakers in the short-term as it is a rational discussion about inflation targets for the long-term. As such, it’s best if we don’t get ahead of ourselves when talking about the necessity for a certain amount of inflation.

Great post.

This is what is happening with lightning network right now. There is no real incentive to stake other than earning very small amounts on transactions and the ‘cool’ factor of it all. The overhead of running a node is very small, can be done on a Pi, so electricity consumption and investment is minimal.

Some differences between LN and Serenity is that it is possible to immediately withdrawal and there is little risk of losing your stake for not behaving properly, downtime, or bugs. I understand that you would rather avoid focusing on the economics, but it is for those reasons why, as a miner / staker who cares about the security of the network, I’m interested in the economics of staking.

In short, Serenity is risky business, which deserves economic incentives to offset the risk.

Thanks Vitalik! Any way to know at the time of withdrawal request how long it will take to receive one’s stake back?

Our team recently published our proposal for Ethereum’s long-term staking economics under Serenity. We’re happy to join the discussion and hope our analysis is constructive. The full report can be accessed at the link below, with staking economics discussed on pages 15-28.

I just read through most of this thread, and there is a point that I don’t believe anyone has made yet: many (maybe most?) people who hold ETH right now do so as a speculative investment. They own ETH because they are expecting it to appreciate in value.

Investors who are long ETH probably don’t mind locking it up to earn more ETH, even if the interest on that ETH is low. Thats because they’re expecting the bulk of their returns to come from ETH’s appreciation. You see evidence of this with people locking ETH in Maker to long ETH with leverage.

If you buy that, it’s actually an argument for setting the interest rates “too low” in the beginning, because we’re not competing with savings accounts or the stock market. We have people holding a risky asset in the hopes of 10-1000x returns. We probably don’t have to pay them much to continue holding it.

But. That dynamic won’t last forever. Eventually, the expected gains from ETH appreciation will be too low for people to hold it long term for speculation. (This will either be because it appreciates a ton or doesn’t, either way at some point the expected gains tend toward 0). At that point, you’ll want to increase the interest rates to maintain security. But that shouldn’t be too hard, as per @haokaiwu 's point, it’s in stakers best interest.

What you glossing over is the risks (of various degrees) involved with that lockup.

- Threat of penalty (only 18 days to lose 60.6%).

- EVM 2.0 never gets finished, so you can never withdrawal your stake.

- Dependency on either hosting the stake yourself or another provider doing it for you (see #1).

- Software bugs that create a Parity-like issue where things are locked up forever.

Why lock up your ETH with risk of losing it, when you can just keep it where it is.

Or even sell it today and put it into a govt bond or bank account which guarantees a steady rate of return that can be redeemed at any point.

That is the incentive that needs to be figured out.

I’m also concerned about the risk/reward ratio.

Ethereum will require 137,000+ validator slots to be filled. This is a lot of validator slots, and a lot of ETH that needs to be staked and put at risk. While Ethereum’s current market cap gives it an advantage over existing and upcoming PoS networks in that there does not need to be a high percentage of ETH staked in order to gain a high level of security, getting the ~5Million ETH to stake in a decentralized fashion will be a challenge with the currently discussed reward system.

- Reward: ~2.5% annual interest (assuming 100% uptime and availability and 10M ETH staked)

- Risk: up to ~60.6% stake slashed in 18 days

Some people like @bendi seem to underestimate the resources required to run a validator node on such networks, and fail to recognize how easy it is to get slashed and that more work and attention is involved than simply pressing a “stake” button.

As @lookfirst mentioned, how will Ethereum attract a diverse set of competent validators when the reward is very low and takes a long time to receive, yet the risk of losing a lot of ETH can happen in days? In its current form and with my current understanding, the economics of Ethereum 2.0 would only attract whale-like validators who are willing to take the risk for their long-term benefit of promoting Ethereum.

While the barrier of entry (32 ETH) is low and sounds nice, it still doesn’t have an attractive reward mechanism for participants with around 50-500 ETH and seems to favor whales, as the risk of being slashed a high percentage of their low stake is not as impactful as it would be to low-income stakers.

At its peak price of ~1000 USD/ETH, that’s $32,000. That’s not low, even by first-world standards. That’s way way higher than the cost of purchasing an ASIC or a GPU.