For an initial reference, I put together a twitter thread on this subject a few weeks back but I’d like to formalize the discussion here.

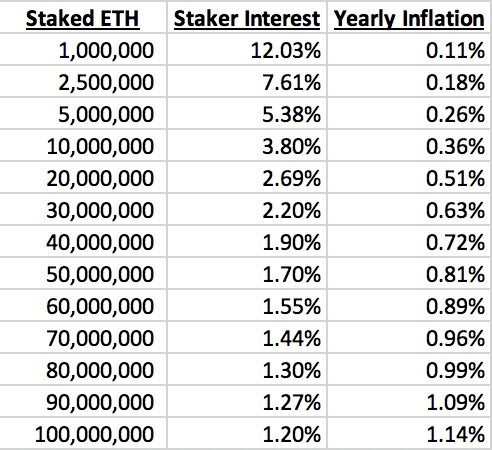

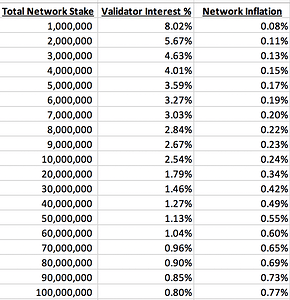

I used the latest spec to calculate the sliding scale of staking payouts versus total network at stake and it looks as follows:

I’d like to open up the discussion around these numbers. There are many complexities involved that I think should be considered:

- What return is the average user looking for considering 32eth of capital?

- What returns will “competitors” built on Ethereum be able to offer for returns on ETH investment. This will impact the attractiveness to current ETH holders.

- What returns will “competitors” not built on Ethereum be able to offer for returns on capital. This will impact the attractiveness to people who may have entered ETH to stake otherwise.

- What will the cost of running a single validator be, cutting into this return?

- How many holders will stake no matter what the return, just like running a node at a loss today?

- How much do we want staked in the network to feel minimally secure?

- Staking rewards are taxable, how will this cut into incentives?

Here are some of my initial thoughts on the above:

- Somewhere around 4% return.

- This will fluctuate wildly on DeFi apps. Relatively risk free interest will be around 0.25%-1% and riskier loans with counter-party risk will be around 5-10%.

- There are 2% savings accounts today but one must also consider inflation. Over a period of say 15-20 years it’s not all that difficulty to average 4-5% returns post-inflation in the US stock market.

- Gathered some VERY preliminary data here and seems a single validator will require: 1-5gb storage and 256kbit/s of internet connection.

- There are 13,000 nodes today but it’s hard to answer this one.

- If I’m reading the spec right then we need 128 validators for a minimum committee size. So 1024*128=137,072 validators, or ~4.2mn total staked ETH.

- Would be somewhat similar to other investment vehicles.

What does this mean? Well, I’m not really sure yet and that’s why I wanted to start this discussion. I personally don’t really see a scenario where the network gains many validators under the 3% return rate (~15mn staked). If that is acceptable for the network to run efficiently, the perhaps it’s fine, but if not should we consider increasing these initial numbers with the downside of slightly higher inflation?