The Influence of CeFi-DeFi Arbitrage on Order-Flow Auction Bid Profiles

Data Always - October 31, 2023

Acknowledgements. Thank you to Comet Shock and Justin Drake for feedback and discussions that spurred this analysis. The results should not be taken as a reflection of their opinions on the topic.

Motivation

Previous modelling of order-flow auctions (OFA) has concentrated on generating a holistic picture of builder behavioral profiles, but has not accurately portrayed special cases resulting from market volatility. This analysis aims to shed light on the steep rise in integrated builders and the class of action that they dominate.

Methodology

We leveraged Binance 1-second interval K-line ETH/USDT data to identify the slots with the highest intrablock volatility between January 1, 2023 and September 30, 2023. We also investigated the slots with the highest absolute price changes and found similar end results. We chose to focus on intrablock volatility to demonstrate that base asset price spikes and crashes are not the only contributing factor, and that improvements in CEX efficiency may not mitigate the dynamic. Further research should expand this methodology to consider other top ERC-20 tokens.

We calculated the trailing 12-second volatility and then resampled the dataset into 12-second intervals aligned to beacon chain slots intervals. We then sorted the slots by volatility and enriched the data with winning bid values and builder information from mevboost.pics. Finally, we downloaded corresponding OFA bid data from the Flashbots, ultrasound, Agnostic and bloXroute relays to model the profile of block bids for known integrated builders (beaver, rsync and manta) against the rest of the builder market.

We modelled both mean and median bid profiles, but present median values here to remain in line with prior research.

We used a control sample of 12,000 slots (starting at slot 7,000,000) as a reference for bid distributions, projected burn share, and to model cancellation times. Ideally this sample would have been larger, but all findings in the control were in line with prior research. The control sample is only used for comparisons to tagged slots.

Results

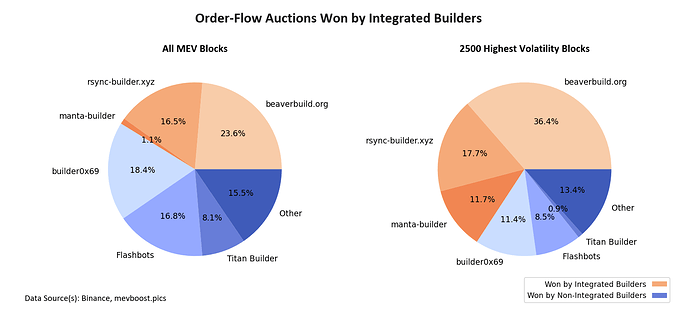

We found that integrated builders won a minority share (41%) of OFAs between January and September 2023 but dominated the tagged high volatility slots, winning 65% of the top 2,500 auctions. These numbers should be treated as lower bounds of the current dynamic, as the share of all blocks won by integrated builders has increased throughout the year and currently sits at 52% for the past 14 days, despite manta-builder ceasing operations in May. The relative share of builders can be seen in Figure 1.

Figure 1: Integrated builders won an outsized share of tagged high volatility slots, while all other builders saw sharp dropoffs in their share of blocks. Titan Builder’s share saw the largest decrease, but this is likely due to the higher concentration of tagged blocks early in the year (before Titan Builder began operating).

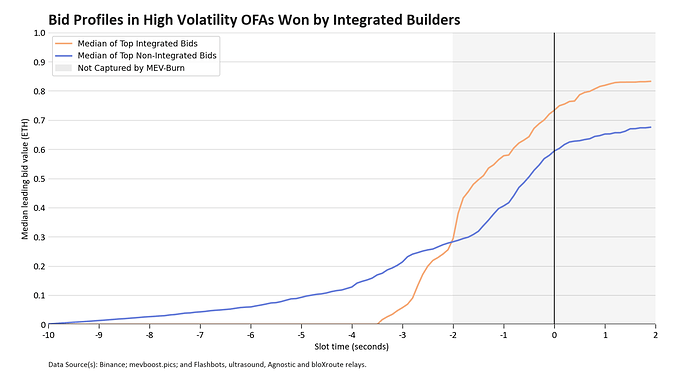

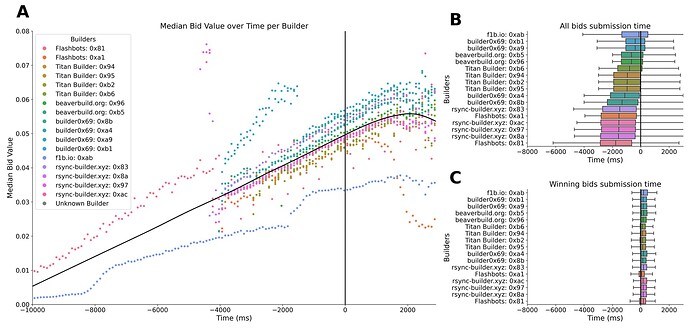

Prior research, which can be seen in Figure 7, demonstrated a linear increase in bid values. However, as seen in Figure 2, our tagged slots show that integrated builder bids follow a two-stage nonlinear profile when leveraging CeFi-DeFi arbitrages. Integrated builders tended to withhold their best bids until two seconds before the canonical block time, only matching the top non-integrated builders until the final moments of the slot. Until the divergence, integrated builder bid values likely contain no proprietary bids and consist of public mempool transactions and transactions sent in by other searchers.

Figure 2: In the median tagged auction, the leading integrated builder bid only surpasses non-integrated builder bids after the proposed MEV-burn cutoff. This suggests that the current proposal is blind to CeFi-DeFi arbitrage.

Under the current MEV-burn proposal, the size of the burn in these slots is determined by non-integrated builders, while the majority of the block value is generated by integrated builders after the burn has been decided. This framing is especially important because as frontends continue to work to eliminate sandwich transactions and to reduce overbidding of priority fees, CeFi-DeFi arbitrages will likely be unaffected and may begin to dominate a greater share of auctions.

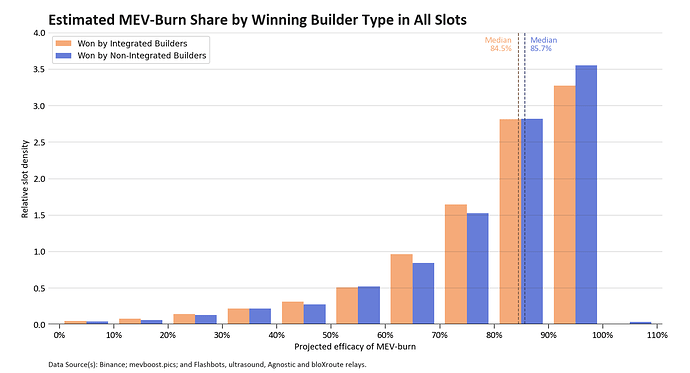

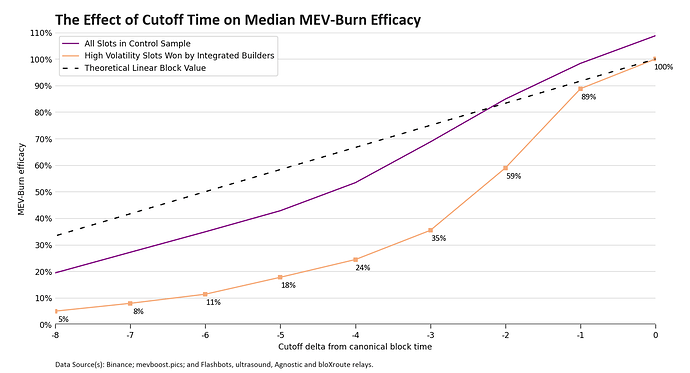

If we consider all auctions, burning the first 10 seconds of bids would historically have been effective. In our all-slots control sample, seen in Figure 3, only 7% of blocks would have burnt less than half of their MEV payout under the current proposal, and the mean burn for both integrated and non-integrated builders would have been 80%.

Figure 3: Our control sample shows that the current MEV-burn proposal captures the majority of MEV, and that only a small share of auctions have significant earnings after the 10-second cutoff. Columns farther to the left see a smaller relative share of their auction value captured by MEV burn.

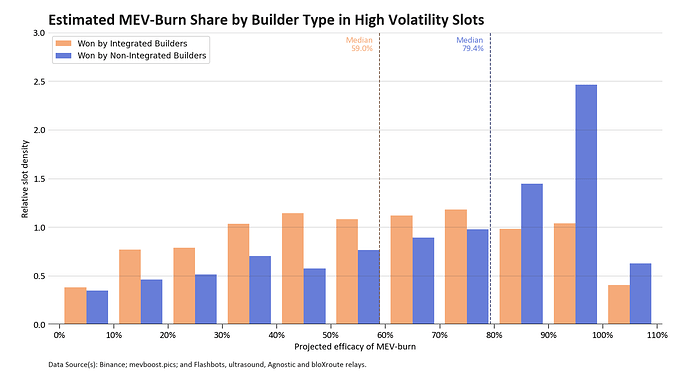

Switching back to high volatility slots, those won by non-integrated builders retain a semblance of the all-slots profile, but these are generally false-positives in the data tagging; they are slots where integrated builders chose not to commit heavily to CeFi-DeFi abitrages.

The distribution for slots won by integrated builders, seen in Figure 4, is closer to a uniform distribution; the value burned is disconnected from the winning bid value. 41% of tagged high volatility slots won by integrated builders would have seen less than half their value burned versus 26% of slots won by non-integrated builders.

Figure 4: The current MEV-burn proposal is ineffective at capturing the value of our tagged special cases, particularly when examining auctions won by integrated builders. If the frequency of these special cases is expected to grow in the future, the MEV-burn proposal may need adjustment.

We can also model the sensitivity of burn efficacy to the choice of burn bid time delta. In Figure 5, we see that the efficacy for high volatility slots is nonlinear, and delays or modifications could result in drastic changes.

Figure 5: The efficacy of the MEV-burn proposal for our tagged slots is highly sensitive to the choice of cutoff time. These blocks do not conform to the linearity assumptions that underpin current efficacy estimates. One of the assumptions underpinning the leading MEV-burn proposal is that block proposers select the block with the maximum payout, but in historic data this is not always the case. This leads to a quirk in the data where if delta is set too aggressively would involve burning more than the realized payouts.

Terminal Shape of Bid Profiles

With the potential for MEV-burn to lead to more timing games, it’s crucial to properly categorize the terminal shape of bidding profiles. Previous research has suggested that these bidding curves have a distinct peak. Thiery’s modelling (Figure 6), showed it to occur at approximately 2 seconds after the slot time and Wahstätter et al. obtained a quadratic function peaking at 2.78 seconds.

Figure 6: Past research has categorized a definite peak in auction bid profiles. This implies that timing games are bound by both the ability of proposers to get enough attestations and the maximal bid value of the auction. We believe that these maxima are a mirage in the data. Source: Empirical analysis of Builders’ Behavioral Profiles

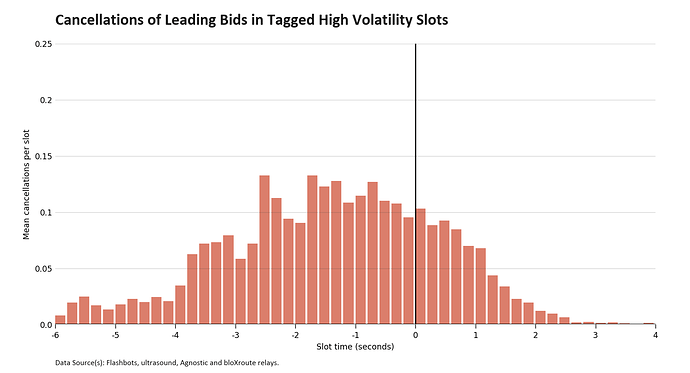

In our opinion, these maxima are mirages in the data. If the values were true peaks, then we should expect to see a flood of cancellations at and after the peak. However, other modelling demonstrates that this isn’t the case and that cancellations tend to occur much earlier in the slot.

We recreated this modelling and confirmed Neuder et al.'s findings, and then extended their modelling of bid cancellations to the special case of volatile slots, finding that the rate of late cancellations was even lower in our tagged blocks.

Figure 7: The majority of meaningful (i.e., leading) bid cancellations occur early in the slot. Very few slots see cancellations that would suggest that bid values are not monotonically increasing in time.

Our analysis, seen in Figure 7, shows that across the four relays, only 1 in 4.4 tagged high volatility auctions had its leading bid cancelled more than 1 second after the canonical block time, and only 1 in 25 slots had its leading bid cancelled more than 2 seconds after the canonical block time. These results demonstrate that prior bids would have remained valid, and that lower median incoming bids are primarily noise and not meaningful to auction dynamics.

The foundation of timing games research is that auction values trend up in time. Since builders have nothing at risk, it follows logically that their average bids should be monotonically increasing.

Discussion

Although MEV-burn is a good idea, the leading proposal has significant gaps that the community must acknowledge and should consider addressing. The proposal is blind to the business model of the two fastest growing (and now largest) builders; combined, these builders win over half of OFAs and both censor OFAC non-compliant transactions.

The community expects the worst MEV offenders (sandwich transactions) to be solved out-of-protocol by changes to dApp frontends, however, this will also serve to weaken the competition faced by integrated builders and may further centralize the PBS landscape by increasing the relative importance of off-chain or cross-chain MEV. The hopeful solution to reducing CeFi-DeFi arbitrage seems to be to shift DEX liquidity onto L2, but this comes with significant trade-offs and relies on third parties to decentralize their platforms adequately.

Ethereum should only enshrine monetary policy changes that pass the highest bar, yet the ecosystem is evolving too rapidly and the potential ramifications around MEV-burn remain poorly understood.

Open Questions

- How much of a role do other ERC-20s play in tagging high volatility slots?

- If DEX liquidity moves to L2s, what will be the effect on CeFi-DeFi arbitrage?

- As front-ends reduce the number of sandwich transactions, will integrated builders become more competitive in all slots?

- In an MEV-burn world, would integrated builders choose to further delay their bids to make the nominal difference a larger factor in OFAs?

- Are proposers more willing to play timing games in low value OFAs?

- If proposers begin to play more aggressive timing games, how much later will bids show up in the data? Where will the peak of the traditional bid profiles extend to?

- If bid cancellations become considered toxic and are removed from OFAs, what will be the effect on MEV-burn efficacy?

- How does the distribution of bid cancellations change if we normalize the data for auctions that have already finished?