The proposed separation of capital holders and node operators would only require small changes in the code, but it would make a huge difference regarding the legal and fiscal approach of POS Ethereum.

A) Legal approach :

The main question is to know whether POS Ethereum would be considered as a security or not. POW Ethereum was not considered a security so far, in part because Ethers are mainly used to run smart-contracts. Yet, with the implementation of POS, this aspect has to be studied closely again.

More precisely, the 4 questions of the Howey test have to be answered :

- is there an investment of money ? (and are there risks of loss requiring investor protection from the SEC ?)

- is there a common enterprise ?

- is there a reasonable expectation of profits ?

- would a profit be derived mainly from the efforts of others ?

It would be better for POS Ethereum not to be considered as a security, because securities have to follow strict and complex rules.

In my opinion, the proposed separation of capital holders and node operators would reduce the risks for POS Ethereum to be considered as a security.

1/ Is there an investment of money ? (and are there risks of loss requiring investor protection from the SEC ?)

The proposed separation of capital holders and node operators would give nothing to capital holders, since all the revenue would be obtained by node operators for their participation to the protocol.

Ethereum holders may obtain a revenue, but it would depend on their agreement with the operator of the node, outside of the blockchain. Such an agreement would of course be very easy if they are at the same time the node operator, but it wouldn’t be required by the protocol.

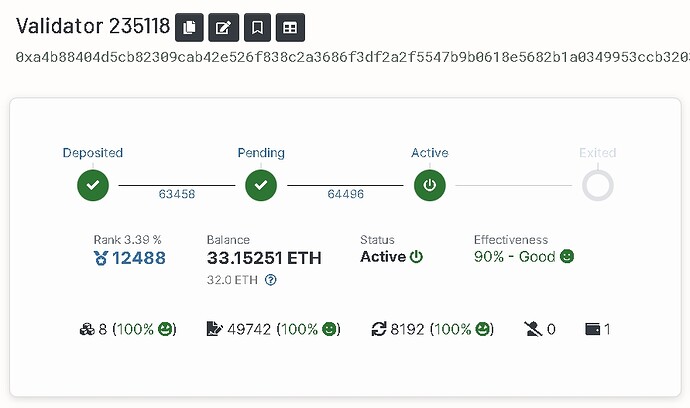

Without any separation, the situation is more risky, because many holders of 32 Ethers are just looking at the percentage they would obtain from staking. It gives the impression that they are investing to get an annual return on their investment. The risks for POS Ethereum to be considered as a security would be much higher this way.

The SEC considered a token wasn’t a security because it was “marketed in a manner that emphasizes the functionality of the Token, and not the potential for the increase in the market value of the Token.”

Ethereum shouldn’t be widely seen and marketed as a way to get an annual percentage on a capital, because of the risk to be considered as a security.

Apart from that, the proposed separation of capital holders and node operators would reduce the risks of loss because Ethereum holders would keep the control of their funds on a separate address.

Finally, capital holders wouldn’t risk to lose their funds during the process of validation, because slashing would only apply to node operators, not to capital holders.

It means additional measures of investor protection from the SEC wouldn’t be needed, reducing the risks of POS Ethereum to be considered as a security.

2/ Is there a common enterprise ?

It seems the SEC has clarified that sharing rewards and delegating validation makes staking services a “common enterprise.”

With the proposed proposed separation of capital holders and node operators, there wouldn’t be any sharing reward or delegated validation inside the POS protocol, because all the revenue would be collected by node operators for their participation to the protocol.

A capital holder may or may not conclude a contract to gain a revenue from the node operator, but it would be their arrangement, outside of the blockchain, outside of the POS protocol.

In many cases, if the node operator is a non profit organization, a college or an university, the capital holder may asks nothing, so all the revenue of the node would be kept by the node operator.

3/ Is there a reasonable expectation of profits ?

With the proposed separation of capital holders and node operators, there wouldn’t be any expectation of profit for the capital holder, because the protocol would give all the revenue to the node operator.

There may be some form of contracts or agreements between them, but outside of the blockchain.

4/ Would a profit be derived mainly from the efforts of others ?

With the proposed proposed separation of capital holders and node operators, it would be easier to argue that capital holders are just passive investors which are just moving 32 Ethers from an address to another, if they want to enable an operator to run a node.

As passive holders, the protocol wouldn’t distribute any profit to them, and the value of their Ethers would rather depend mainly on the supply and demand, not on the efforts of others.

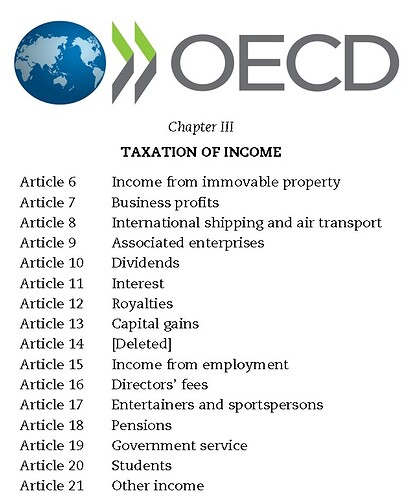

B) Fiscal approach :

The proposed proposed separation of capital holders and node operators would be much better regarding the clarity of taxation : all the revenue of staking would be paid to the node operator. It would therefore be entirely a revenue of independent business activity.

Without any separation, it’s difficult to say if the revenue is an interest on the 32 Eth staked, or a revenue of the activity of node management. Many countries require a trade registration for mining or staking, meaning they consider the participation to the network as professional activity. But at the same time, many stakers consider that it is just an interest they collect on their capital. So the situation is pretty confusing.

Without any separation, it is also very difficult to say which Ethers are sold. For example, let’s consider someone who has 32 Ethers on an address. He stakes his Ethers, and a year and half later, he has a little bit more than 34 Ethers on his address. At this point, this person is selling 1 Ether. Without any separation, it’s very difficult to say if the Ether sold comes from the Ethers obtained from staking, or if it is part of the 32 Ethers he had before starting to stake.

This is very confusing because in one case, the revenue may be considered as business income, and in the other case it may be a capital gain. And things can be more complicated because of local rules.

For big stakers, this may result into heavy tax penalties just because they filled the wrong case due to this confusion.

With the proposed separation of capital holders and node operators, contracts may occur between them, but it would be outside of the blockchain. Some custom contracts may be opportunities to structure the revenues and wealth of both.

For example, it may be possible for node operators to earn revenues of independent business activities, or to earn wages if they run a node inside a company. Depending on local rules, it may be more interesting to gain whether business income or wages, because of health insurance, retirement benefits, lower taxation rate, …, …

For Ethereum holders, it may be possible to contract with node operators and to earn a fixed revenue rewarding the use of their Ethers to fulfill the capital condition. The contract may also decide that the revenue would vary depending on many factors.

It may also be possible for Ethereum holders to earn dividends : they would for example create a company, and provide a capital contribution made of the right to use Ethers to fulfill the capital condition of staking. The company would run the node, and, with the profit, would be able to pay dividends to the shareholder. Since the Ethereum holder would just have to move Ethers from one address to another address of his choice, he would keep the ownership of his Ethers, having just transferred to the company the right to use them for staking, in exchange of shares of this company.

For Ethereum holders, it may also be possible to collect tax deductions if they give to charities the right to use their Ethers to fulfill the capital condition for staking. It may therefore be possible to collect tax deductions while passively holding Ethers (depending on local rules).

As a conclusion, the proposed separation of capital holders and node operators would improve fiscal clarity, predictability and optimization.

And it may reduce the risks for POS Ethereum to be considered as a security.