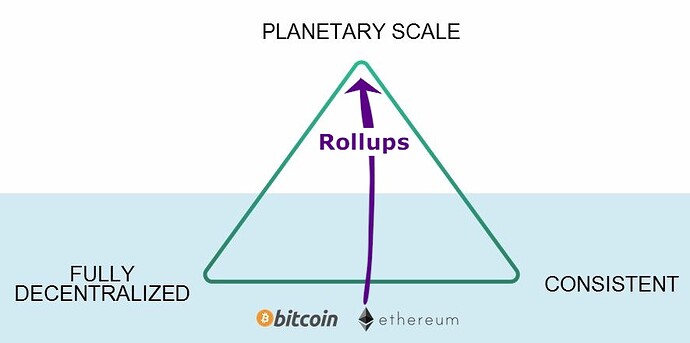

At it’s core, scaling is a technology narrative. It’s the story of new technology (rollups) and a newer technology (zero knowledge proofs.)

We’re at a turning point now with a transition from multi-chain L1 to multi-chain L2 narratives. The alt-L1 bubble was a perfect storm that is now ending. For many months alt-L1’s enjoyed a period of near-0 competiton. Ethereum L2’s weren’t ready yet, and as such any technology that didn’t sacrifice on decentralization could not compete. While competition was still building their first product, alt-L1’s were first to market. By bootstrapping something cheap (but functional!), they soaked up excess demand unwilling to pay Ethereum fees, and the alt-L1 multi chain hypothese arrived.

Scaling, and any argument of “my blockchain is better because it’s fast and cheap,” is going to become a commodity. And fast. Going forward, you have the rise of an army of highly talented, well funded, competition in L2s that are, right out of the gate, more secure and decentralized than alt-L1s and are built to use sound money on a credibly neutral platform. Some of these will be popular and mainstream tradFi L2’s like Visa and Mastercard.

L2 adoption is happening now, even if it is slow and in bursts. Behind the scenes L2’s are improving reliability, decreasing fees, and increasing accessibility. L2’s are still building and improving, and that’s fantastic.

L2’s are inherently collaborative and a bridge economy is emerging. Ethereum has an upper hand in the L1 competition because L2’s will compete directly with L1’s. The future is filled with much more competition for alt-L1 chains than the past. However, it’s more than just increased competition. L2 bridges allow the L2s to be inherently collaborative. Where funds can bridge from L2 to L2 without security sacrifices, funds bridging to alt-L1’s lose significant security. As the funds involved increase in size, this starts to matter more and more, increasing L2 network effects to the exclusion of alt-L1’s.

The argument that L2 bridges are fundamentally more secure at size than cross-chain L1 bridges adds significant drag to alt-L1 competition. If there are limits to borrowing network effects from other chains unless you’re an ETH L2, then ETH L2s can feed off of each other’s growth while alt-L1’s are limited in their ability to do the same. Each L1 must provide the full suite of products on its own, whereas L2 users can just bridge to wherever they want if products aren’t ready yet on their L2 of choice.

The narrative so far has been “alt-L1s have a huge lead because of strategic sacrifices in decentralization.” But honestly, alt-L1’s have not solved their scaling issues quite yet. This isn’t to say they can’t be solved - it’s just to point out that in competition with an army of L2s, they aren’t as leaps and bounds ahead as marketing would make it seem.

Were alt-L1’s ever even sticky? Alt-L1’s cost nearly nothing to use, so they make nearly zero in fees. While that’s been great for users, it remains to be seen if alt-L1’s have a value prop to users outside of low fees. On the other hand, Ethereum users were willing to pay $9 billion in fees last year for the product. They were willing to pay 380x more for Ethereum blockspace than Solana blockspace. If Ethereum gets cheaper, there’s every reason to think Solana users might want in on Ethereum blockspace. I don’t see any reason why Ethereum users will suddenly want Solana blockspace.

The Ethereum ecosystem being built this way - a value proposition built on decentralization and security - sucked for a long time. However, the economy we’re left with is also much more comfortably forecastable. Alt-L1 users were never really forced to anchor themselves into the blockchain and community in the first place, so the network effect that remains should be much more fragile. While it is possible there is some network effect entrenchment for them, they must trust and hope the users will stick around for the long run. For Ethereum it’s verified and is observable with fees paid by users for a product they prove they love with their behaviour, over and over again.

Ethereum has no competition in security or decentralisation. Proof of stake will increase security by orders of magnitude and as the triple havling plays out, Ethereum will emerge as the only blockchain with geopolitical grade security and decentralisation. Ethereum is and will be the only credibly neutral blockchain in existence.

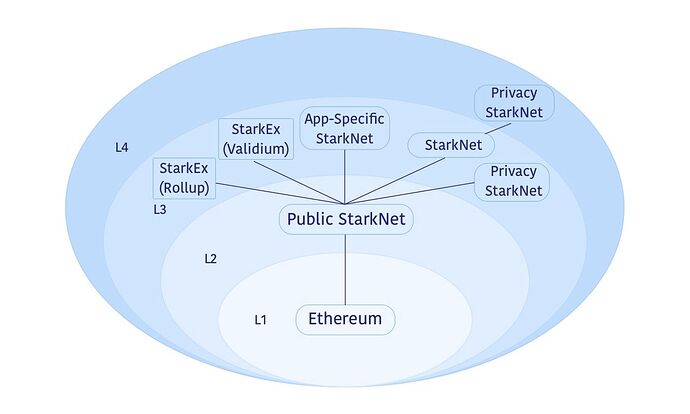

The L3 and L4 narrative is also rising. Recursive rollups. fractal hyper-scaling, app-specific requirements, and privacy built on top of the L2. Multiple scaling layers, all maintaining the security of L1. A while new avenue of possiblities previously thought impossible that can only be enabled L2. There are tasks that only L2’s can perform. The rise of L2-native dapps will be another competitive advantage of the L2 ecosystem.

L2 onramps are here. CEXs won’t just bridge to any random alt-L1. There are real security concerns when it comes to managing money. However, when it comes to L2s with the full security guarantees of Ethereum…all CEXs have an incentive to integrate with the full network of L2s (and even just 1 unlocks the rest via L2 bridges).

The Optimism airdrop marks the launch of L2 season. The wait till now has given time for L2’s to build product, bridges, onramps and applications. So now when the L2 airdrops attract major attention the L2 experience is better than ever before, and the people that the attention brings to the ecosystem will stay.

An immense amount of funding has entered the L2 space and a lot of this funding is going to result in product launches in the next 1-3 years.

After L2 adoption and the merge, there will be a major narrative shift to sharding and the data-availability layer. This will widely benefit every L2 and provide a scaling advantage relative to alt-L1’s. Alt-L1’s can’t just use rollups and sharding. Ethereum is so decentralized it can support 64 shards today (perhaps more in the future). Alt-L1’s don’t have enough validators to do the same.

Sharding isn’t a prerequisite for increasing data availability on Ethereum. But when it does get here Ethereum is massively advantaged in how many shards it can have and it will be the only ecosystem capable of this degree of organic scaling.

The success of L2s built on Ethereum will cement Ethereum’s kingship in the background. There are no other blockchains that have a roadmap like this. Ethereum has a scaling roadmap without tradeoffs on security or decentralization, and in this respect it has no competition.

-

TLDR

-

We’re at a turning point in the scaling narrative:

-

ZK tech is innovating fast

-

Alt-L1 bubble has burst

-

L2 adoption is happening now

-

L2’s are still building and improving

-

L2’s are inherently collaborative

-

Alt-L1’s aren’t finished products either

-

Alt-L1’s may not have been sticky

-

ETH has no competition in security/decentralisation

-

L3/4 is an upcoming narrative

-

L2 onramps are here

-

L2 token airdrops are here

-

More funding is coming

-

Sharding and data availability is next in line on the roadmap