Thanks I appreciate the steelmanning of arguments, which is fairly in line with my thinking/writing, and the division into six distinct topics. I will respond to your counterarguments on these topics one by one.

1. Solo-staker modeling overstates yield advantage

Correct median calculation

This is an important topic that we shall now go over carefully. The expected yield is the most relevant measure to solo stakers and delegating stakers alike. This is the preferred measure, coupled with a measure of variability over a time frame of one or a few years. A prospective solo staker might also want to know what the median outcome (or any other order statistics) would be over some given time period, perhaps a year or two, or until their hardware investments have reached their depreciation horizon. Order statistics can thus be relevant on a per-validator basis over longer time.

Computing the median across all validators over some minuscule time period, and then averaging these medians over time, fails to capture the probabilistic outcome facing the staker. It is obfuscated by a skewed daily distribution combined with the law of large numbers. Half of the validators will never propose a block during the same day, yet half will still propose within a few months. The signal is destroyed by computing the order statistic (median) at the wrong point across the wrong dimension.

To check if it is raining, do not extend your hand and measure the median number of fingers impacted by raindrops every millisecond. The result will always be zero; yet it might still rain.

Modeling current conditions

The figure showed the distribution of yields over a year in accordance with 29M ETH staked and MEV revenue of 2023 (around 300k ETH per year). This was the relevant data at the time of publication in January 2024. The previously linked specification further stipulates that it captures ideal attestation performance with an approximately similar level of missed sync-committee attestations and block proposals as today. The purpose of showing the figure in my last response was to highlight the technical error in the median calculation. I made no references to exact yield figures because it is not relevant to the question of the correct mathematical process and the shape of the resulting yield distribution.

Thus, the major discrepancy is not theoretical projections relative to real-world outcomes (it was accurate at that specific time point), but how the median is calculated. This is easy to confirm by computing idealized performance at the current D = 33.45M ETH but to exclude proposal and sync-committee revenue

The result corresponds to the outcome when calculating the median at the wrong point across the wrong dimension (counting the median number of fingers hit by a raindrop every millisecond to determine if it is raining). The marginal difference here between 2.41% (or 2.39%) and 2.426% is mainly attributable to a lower-than-ideal attestation performance.

The benefit of using a simulation is that it becomes possible to analyze how the outcome will change with D and the level of MEV. The associated post leveraged this to show the outcome at for example 50M and 70M ETH staked in Figures 16-18. As evident from those plots, the yield falls when D rises.

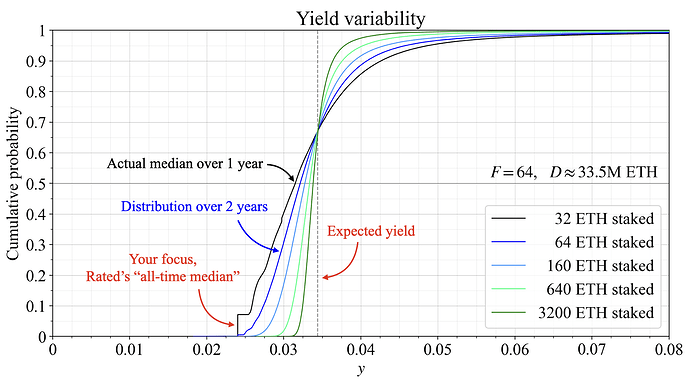

The simulation can also be adapted to the current circumstances with D = 33.45M. We could even lower the MEV level to 200k ETH per year as implied by Rated, eventhough this is a bit problematic: Rated seems to define their “all-time” measure to be the last 90 days, making that MEV estimate susceptible to short-term trends (not clear if this was understood in your response). In any case, by reducing the average block MEV in the data used in my previous post so that the yearly figure falls from around 300k ETH to around 200k ETH (linear normalization), these new assumptions can be modeled. For good measure, attestations are set to capture 99% of maximum rewards across the board, bringing the baseline down from 2.426% to 2.402%. The outcome for stakers over one year is shown in the figure.

I highlight again the tiny vertical line segment of the black line (at 2.402%). This is the small fraction of solo stakers that your analysis is based on. But as evident, the median for solo stakers will over a year already be above 3%. I repeat again that after 2-3 years, there will hardly be any unlucky solo stakers left at the lowest level. This is evident by observing the blue 64-ETH distribution (two years of non-pooled staking for a 32-ETH validator) and the 160-ETH distribution (five years of non-pooled staking).

Concerning the linked report, it seems to rather indicate that solo stakers capture around 97.8% of the average rewards (4.31% relative to 4.41%). This would be unfortunate, but the staking commission would still be a much larger part of rewards. There is then some noisy subgroup data that seems perilous to draw conclusions from. Thus, regardless of whether solo stakers bring in an expected yield of 3.44% or 3.36% currently, they certainly do not bring in a yield of 2.4%, and the median of the distribution will approach the mean with time.

In conclusion, going forward, we must make sure to not rely on an erroneous median for modeling purposes and to not confuse the argument by invoking misapplied empiricism.

2. Node operators raising commissions could be beneficial to solo stakers

My contention was that if a reduced APR leads to node operators raising their commission, then the relative difference in revenue between solo stakers and delegating stakers will increase. I then noted that

Thus, while all stakers could lose from lower issuance (this is however not certain, it is a separate topic discussed here), the benefit discussed was at the protocol level. If node operators greatly raise their commission, then this produces an economic pressure pushing the proportion of solo stakers higher. The point is that we cannot ignore the take-home of delegating stakers, because the willingness to delegate stake relative to the willingness to solo stake will also vary with commission rates. So it was an attempt from me to steer the analysis into being more complete by also accounting for this effect.

3. CEX dominance is in decline today and we do not provide a model to support the idea that large inflows of new stake would accrue to them

My overarching point would be that as Ethereum scales and the technology improves, the value of operating onchain should increase. The trend would then continue, which seems like a reasonable default assumption.

Most, if not all, SSPs operate with the purpose of deriving profits; CEXes are not materially different in this regard. A CEX might be able to lean into its stronger regulatory oversight to attract stake without making full disclosures, whereas some entity operating under less regulatory scrutiny instead could seek to provide assurances through onchain transparency or leveraging known operator identities in other ways.

We have seen how opaque setups have failed in the past, so full disclosures certainly make for a more attractive service provider. However, being opaque at lower stake participation is more of a threat to beneficial owners than to Ethereum. If Coinbase were to seemingly approach critical thresholds of stake participation (say 25% or 33%) and not be forthright about its stake under management, there would be mounting pressure from the community for greater clarity, and they would make themselves even less attractive. Passing 33% in secret would arguably subject beneficial owners to high risks. The social layer has a wide range of options available that potentially involve loss of funds and/or ejection, say in the event of centralization coupled with contentious forms of consensus participation that could be more benign to Ethereum at lower stake participation.

4. Our framing of issuance cost is reductive and only focuses on taxes

Thanks. Yes, that integral bounded by the two equilibria has been computed to Y'_c = \int_{D_2}^{D_1} f(x)dx\approx 446k ETH (though the supply curve is very hypothetical). The welfare gain is applicable to the entire circulating supply and must be spread out across it:

i.e., 0.37%. The welfare gain corresponds to around 1.5 billion dollars per year, which is no small sum by itself. Yet, it is important to note that this is not a fixed one-time gain. The cost reduction continues to bring a similar welfare gain year over year, and its value is therefore much higher. Comparing with a tech company valued at a p/e ratio of 30, a 1.5 billion gain in profits increases the value of the underlying asset by 45 billion. While the comparison is not perfect, if we are to attach a value to the cost reduction, that figure is probably closer to the mark.

5. The social layer exerts its influence beyond the staking layer

I do not think that the importance of diversity in the validator set is a point of contention. We both want a diverse validator set. The important point is that if an attack requiring social intervention indeed does happen, then if all ETH is tied up in staking, this would be a very fractious process. It is in this light we must understand my response to the post:

Note here the importance of the last part: whose mere existence would presumably scare off any would-be attacker. We both wish to avoid any attack happening, but I contend that if the threat of an independent neutral social layer is removed, the risk of the attack happening in the first place increases (and of course the potential consequences as well). Note also that an “attack” must not be an obvious violation, easy to come to social consensus on. It can involve chipping away at the properties that we wish the consensus mechanisms to uphold (e.g., censorship resistance).

6. Allowing incumbent LSTs to dominate could lead to centralization

The level of the staking yield will directly influence whether or not non-staked ETH remains attractive to the majority of users. Ethereum’s roadmap can influence many things, but it is not necessarily that influential on the risk-adjusted value of holding an LST relative to holding non-staked ETH. We primarily address this with a deliberate issuance policy. I do not actually subscribe to the notion that all ETH will be staked under the current issuance policy. But I certainly subscribe to the notion that the outcome is determined primarily by issuance policy (including MEV burn).