Endgame Staking Economics: A Case for Targeting

by @adietrichs and @casparschwa .

This post explores the status quo of staking economics, its drawbacks as we see them and what the endgame of staking economics could look like.

Read about our separate proposal for an immediate issuance policy update in Electra here.

Many thanks to Anders, Barnabé, Francesco, Julian, Dankrad, Thomas, Vitalik, Mike, Justin, Jon, Nixo, and Sam for feedback and discussions.

Reviews \neq endorsements. This post expresses opinions of the authors, which may not be shared by reviewers.

tl;dr

- Today, 30M ETH or 1/4 of all ETH, is staked, with the trend of increasing staking showing no signs of stopping.

- We argue that most of new stake will be driven by LSTs, which gain in money-ness with adoption and time.

- A world in which most of ETH is staked through LSTs has several implications that we consider negative: LSTs have winner-takes-most dynamics due to network effects of liquidity. Economies of scale increase competitive pressure for solo staking viability. Further, a LST replacing ETH as the de facto money of the network (apart from L1 tx fees) leads to Ethereum users being exposed to counterparty risk inherited by the LST by default. For true economic scalability the money of Ethereum should be maximally trustless.

- Today, the issuance yield does not ensure a limit to the amount that can be staked profitably. LSTs have significantly changed the cost structure of staking, making it possible that most ETH will be staked eventually.

- We argue that endgame staking economics should include an issuance policy that targets a range of staking ratios instead, e.g. around 1/4 of all ETH. The intention is to be secure enough but avoid overpaying for security and thereby enabling said negative externalities.

- Finally, we highlight some open research questions that need answering to make a targeting policy feasible.

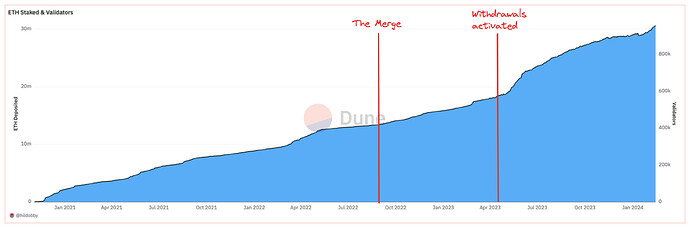

The figure below shows the amount of ETH staked over time. Historically, staking has known one direction: up only. In this post, we put forward arguments for why we think this trend will likely continue, what the negative externalities of it are, and make a case for a path forward to avoid this plausible future.

In short, the current issuance policy allows for all ETH to be eventually staked. This arguably over-secures the protocol and comes with negative externalities. We elaborate why the endgame of staking economics should target a staking ratio range instead. The intention is to provide enough security for the protocol, while limiting the negative externalities of too much stake in the system.

Current Issuance Policy – where we are & where it’s going

To frame our argument, we reason about what long term equilibria of stake participation are viable under the current issuance policy.

The Ethereum protocol requires some stake participation to secure itself. The demand for stake is very clearly defined in the form of the issuance curve. Given some level of stake participation, the protocol issues some maximum amount of rewards. Instead, the willingness to supply stake varies across ETH holders and is not public knowledge. Hence, we are left to reason about it.

Demand for Stake – take my ETH and give me security

Ethereum inherits its security from its validators, who stake ETH for the right to earn rewards. The protocol’s demand for security is expressed in its willingness to issue ETH for validators correctly performing their assigned duties. How much security is sufficient and how much might be too much is discussed here, here and here and otherwise beyond the scope of this post.

The Ethereum protocol issues new ETH to recruit ETH holders as stakers. It rewards correct validation according to a fixed issuance curve. Further, validators earn MEV rewards in their role as block proposers. Both sources of yield contribute to the incentive to stake.

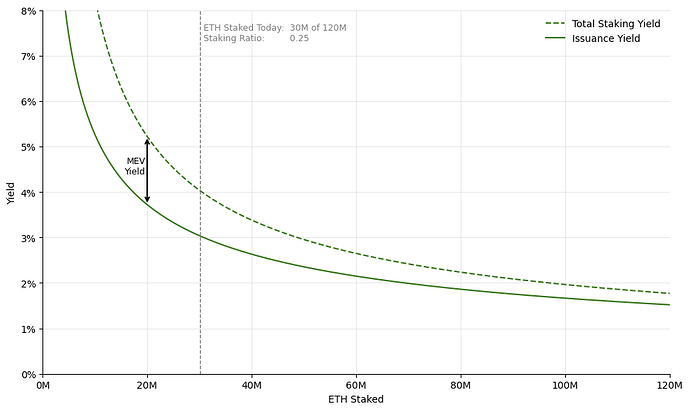

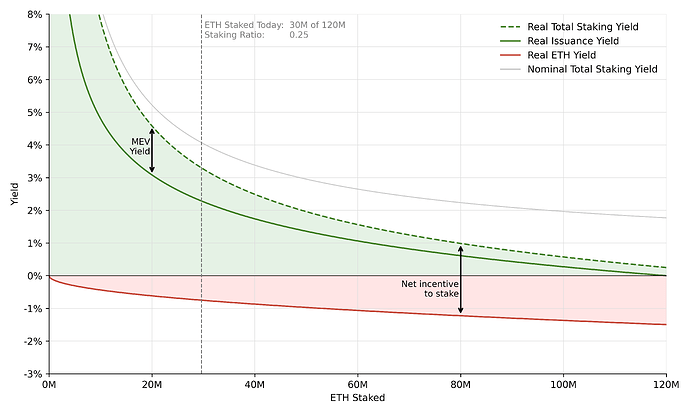

Issuance yield (solid green line). The current issuance yield curve is defined as y=\frac{cF}{\sqrt{ETH\ Staked}} with c\approx 2.6 and F=64 and represents the maximum issuance yield available for an optimally performing validator [1]. The rewards decrease as staking participation increases – first quickly, then more slowly. The protocol tries to ensure some minimum level of security and thus rewards validators more generously at low levels of staking participation. As more stake secures Ethereum, the marginal value of validators decreases and hence staking rewards are reduced.

Total staking yield (dashed green line). It is the sum of (nominal) issuance yield and MEV yield and forms the demand curve for stake [2]. MEV yield is exclusively available to validators in their role as block proposers. It is calculated as the annual amount of MEV extracted (~300,000 ETH over last year) over the amount of ETH staked. As a constant amount of MEV is shared by more validators, MEV yield decreases more rapidly than issuance yield, because it does not change with staking levels. The amount of MEV has stayed remarkably constant over time. While this could clearly change, for simplicity we will refer to the demand curve as fixed.

The current issuance curve was chosen over a plethora of reasonable functions. This particular curve conveys two clear messages:

- It deliberately aims to avoid too low staking participation, by paying out very high rewards at low staking levels.

- It suggests diminishing marginal utility for each additional staker, with issuance yield decreasing as staking participation increases.

However, the issuance curve is not intentional about the level of staking participation it wants to achieve. Notably, there is no mechanism to prevent the staking ratio from exceeding some threshold. In fact, even if the entirety of ETH is staked, the incentive to stake still mounts up to ~2%, favoring those who stake over those who do not. While the issuance curve subtly suggests that the value of each additional staker diminishes, the protocol does not exert fine control over the eventual staking ratio reached. Essentially, beyond ensuring minimum security through initial high incentives, the protocol doesn’t encourage an optimal range of staking levels.

Note that the issuance yield depicted above is nominal yield. It does not account for the dilution that takes place as more ETH is issued. The relevance of this dilution effect increases as more ETH is staked. However, as it affects both staked and unstaked ETH equally, it does not affect the net incentive to stake (i.e. the yield gap between holding raw ETH and staking it). We can therefore ignore dilution in this analysis for now – we will get back to it at a later point in this article.

Supply Side – give me ETH and have my stake

Having explored the demand for stake, we now turn our attention to the supply side. The supply curve represents the willingness of ETH holders to stake at different staking yields, indicating the necessary incentives for each stake participation level. This curve typically slopes upwards, suggesting that higher staking participation levels require greater incentives. However, since the willingness to stake cannot directly be observed or measured, the exact shape of the supply curve remains unknown, only allowing for qualitative assessments.

In addition, the supply curve is not fixed over time. In the following sections we will illustrate how staking costs change over time, and such changes naturally impact the level at which ETH holders need to be incentivized to stake – in other words, they shift the supply curve.

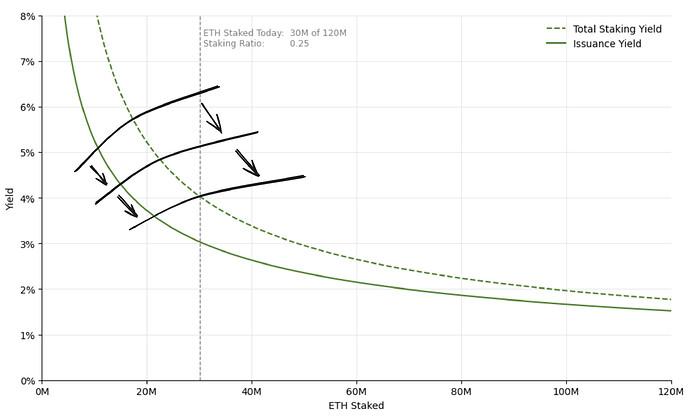

The only direct observations of the supply curve that we do have are the historical staking levels. These represent the intersection between demand and supply curve at any given moment in time, and with the demand curve known, this gives us certain knowledge of a single point of the supply curve for each historical moment of the beacon chain, up to and including today.

As the first graph illustrated, the total amount of staked ETH has continued to grow since the launch of the Beacon Chain. Given the demand curve has remained constant [3], it then follows that this growth in ETH staked is due to a downward shift of the supply curve. In other words, this indicates that the willingness among ETH holders to participate in staking has increased – even at today’s lower issuance yield levels. The following graph illustrates this trend by sketching out plausible shapes of historical short term supply curves:

Just looking at this historical trend, it is clear that for the near-term future, a continued downward shift of the supply curve and thus a continued net inflow of stake is reasonable to expect. However, the more interesting questions are those about the potential long term staking equilibria. To be able to make informed assessments here, we need to have a closer look at the composition of the supply side.

The decision for any ETH holder to stake depends on two things: The incentives provided to stake (total staking yield = issuance yield + MEV yield) and the costs of staking. While the former is relatively homogenous across stakers [4], the cost structure fundamentally varies for different staker types. In the following we contrast solo stakers and staking service providers.

Solo Staking vs. Staking Service Providers (SSPs)

Staking Service Providers (SSPs) receive ETH from their users and stake it for them, charging a fee for their service. In most cases, they give users liquid staking tokens (LSTs) as a receipt for their ETH. An LST is fungible and can be freely used and traded. The extent to which this liquidity is useful for it’s holder varies among LSTs and is a function of overall adoption and support by third-party protocols for a given LST. In the following we will only talk about LST-issuing SSPs - those that do not issue LSTs can be considered as a special case of LSTs with zero liquidity value.

Solo staking is trustless, but illiquid and inconvenient; liquid staking requires varying degrees of trust but is very convenient and importantly liquid.

| Solo Staking | SSPs | |

|---|---|---|

| Costs | High fixed costs: hardware + setup effort. additional variable costs (internet connection, electricity, etc.) | Variable costs: SSPs typically take a cut of validator rewards (e.g., 10%, 14%, 25%,…) |

| Risks / trust assumptions | Trust your own node operation | Node operator risk + smart contract / legal risks + governance risks [5] |

| Convenience | Requires technical skills for setup and ongoing maintenance. | Offers a simple, one-click solution to earn yield. |

| Liquidity | Limited (to restaking); ETH is locked in the deposit contract. | Varying, but potentially high; LSTs are widely integrated in various protocols, enabling liquidity and revenue streams. |

Comparing these two staking types suggests two main conclusions, relevant to the supply discussion:

- The cost structure for solo staking is heterogeneous across ETH holders. The technical skill required, the variation in local cost for hardware and ongoing resources, and the difference in confidence in successful safeguarding of the ETH at stake, all contribute to a relatively steep supply curve for solo stakers. Without major improvements in solo staking UX, the pool of possible solo stakers at anything close to current issuance levels is likely mostly depleted.

- In contrast, the cost structure for SSPs is much more homogeneous across ETH holders, with variation mostly in the assessment of operator risk and the LST-vs-ETH liquidity penalty. As a result, the SSP supply curve is considerably flatter, meaning that the issuance required to recruit more ETH holders as liquid stakers, only increases slowly.

In addition, the cost of solo staking remains independent of the level of staking participation, whereas the cost of holding LSTs will likely go down over time and with increased adoption:

- Money-ness of LSTs increases. As one LST becomes more popular, it can be expected to be supported by more and more projects in addition to native ETH (e.g. more defi integrations, L2s starting to liquid-stake bridged ETH by default). With a sufficiently high staking ratio, the winning LST could eventually even surpass the remaining unstaked ETH in available volume, completely closing (and potentially even flipping) the gap in liquidity.

- Smart contract risk decreases: “battle tested”, formal verification, etc.

- Governance systems improve their robustness, e.g. this proposal.

- Perceived tail risks of mass slashing might decrease. Any LST scaling to subsume a significant portion of the overall ETH in existence could reasonably create a too-big-to-fail impression, where users expect a protocol bailout in case of failure, effectively driving down their perceived operator risk to 0.

- SSPs can offer lower fees to break even at higher staking ratios.

In summary, this suggests that the supply curve is significantly flattened by SSPs and LSTs in particular, meaning the incentives required to attract additional staking do not need to increase substantially as the total amount of staked ETH grows. A continued future increase of stake driven by liquid staking can be expected. But just how much more ETH will be staked in the long run?

Long term equilibria – are we gonna keep staking or what?

We now put together the demand and supply considerations to reason about possible long term staking equilibria.

We argued that the demand curve is very opinionated for low staking participation but otherwise leaves it relatively open what staking ratios might be reached in the long run.

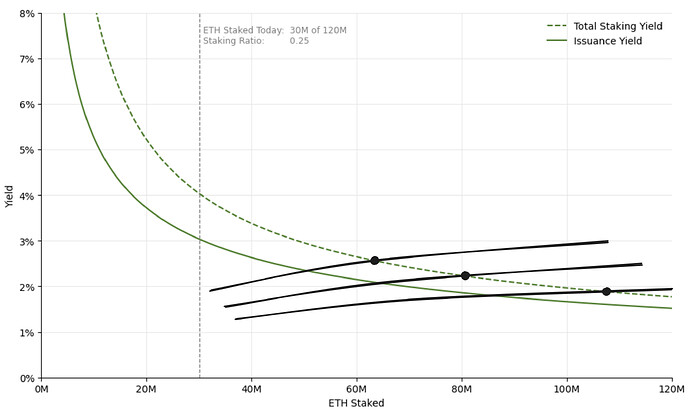

We then explained the dynamic of downward shifting supply curves over time, as the costs and risks of staking continue to decrease. The resulting new net inflow of stake will mostly flow towards LSTs. In particular, it is unclear whether the supply curve would be steep enough to set practical limits to staking participation.

Thus, there is a broad range of possible equilibria for the overall staking ratio, with ratios close to one among the plausible outcomes. The following sketch illustrates how even relatively small differences in the (hypothetical) long term equilibrium supply curve can lead to very different outcomes:

The key take-away is not that staking participation levels will necessarily be high, but that such high levels are plausible.

With this in mind, we now detail our concerns around high staking ratios, before presenting possible changes to the issuance policy preventing these.

Staking Ratio – when is less stake more?

With ~30 million ETH staked from a total supply of ~120 million, the staking ratio s is defined as \frac{ETH\ Staked}{Total\ Supply\ of\ ETH} and stands at \frac{1}{4}.

Before diving into the concerns we see for high staking ratio regimes, we again point to some references, discussing what level of stake participation might be secure enough. In short, current staking levels are arguably sufficiently secure. This then raises the question - if we don’t need it for security, should we be okay with staking participation sufficiently higher than today?

We argue that high staking ratio regimes come with negative externalities that affect ETH holders, (solo) stakers, as well as the protocol itself.

Network Effects of Money (LSTs) – no thanks to forced risk taking

- LSTs compete on money-ness with winner-takes-most if not all dynamics due to network effects. As a LST is more widely used, it becomes more useful driving further adoption. The money-ness of LSTs increases in aspects such as degree of integrations (on- and offchain), trading liquidity, resilience against governance/legal attacks, etc.

- In a high staking ratio regime in which one SSP controls most stake, the LST may be considered too-big-to-fail. Is it a credible threat to slash, if a majority of all ETH in existence would be affected? More generally, the governance of such a dominant SSP would de facto become a part of the protocol, without being accountable to all Ethereum users.

- In a world in which most existing ETH is liquid-staked, the de facto money of Ethereum for most use cases besides L1 transaction fees will be some LST(s). All LSTs, be they issued by an ETF, centralized exchange or onchain staking pool, come with different trust assumptions – some worse than others. But ultimately Ethereum users will end up holding LSTs, economically quasi-forced to expose themselves to those added risks (operator/governance/legal/smart contract/etc. risk). Is this desirable for Ethereum users? Further, such intermediated ETH is worse collateral. For true economic scalability, the money of Ethereum needs to be maximally trustless: ETH.

Minimum Viable Issuance – in it for the UX

- Minimum viable issuance as a guiding principle suggests enough staking participation to be sufficiently secure, but not more. There comes a staking level beyond which the protocol is secure enough and the marginal utility of a staker turns negative (networking load increases, ETH holder dilution, etc.).

- Ethereum users should not have to concern themselves with the complexities of staking to prevent their ETH holdings from getting diluted. Staking is a service that the protocol requires and pays for, but it should not be economically quasi-forced upon all its users.

- More issuance implies more dilution for all ETH holders and stakers. However, SSPs are shielded from this downside. They don’t hold the ETH that underlies the staked position, but instead derive their revenue from SSP fees that they charge for their services, which naturally increase for higher staking ratios.

- At a hypothetical staking participation level of 90% with 2% yield, assuming a liquid staking share of 90% and an average SSP fee of 10%, 0.16% of Ethereum’s market cap, or ~200,000 ETH, or ~530 million USD at current prices, are paid in SSP fees every year – a de facto tax on all ETH holders.

Real Yield – the real deal

As we discussed in the beginning of the article, the nominal yield for stakers from issuance is progressively diluted with higher staking participation. To adjust for this effect, it is useful to look at the real staking yield.

Real yield is nominal yield adjusted for the dilution effects of ETH issuance [6].

The graph depicts the impact of dilution on yield for both stakers and non-staking ETH holders. For ETH holders (red line) this implicit yield is of course negative, as their nominal balance remains unchanged, while they are exposed to the same dilution effect as stakers. To better characterize the impact of this effect, we can broadly distinguish between two different staking ratio (s) regimes:

- On the left, for low s, the real yield curves relatively closely resemble the nominal yield curves we previously examined. With few stakers the total amount of new ETH minted is respectively small, resulting in only a small dilution effect. The net incentive to stake is made up primarily by the positive yield available to stakers – or visually it’s mostly green.

- On the right, for high s, the real issuance yield diverges more strongly from the nominal yield curves. With an increased number of stakers earning validator rewards, total ETH issuance is higher, leading to this more noticeable dilution effect. Besides the diminished real yield, a significant portion of the net staking incentive now derives from “dilution protection”, essentially the avoidance of losses that would be incurred by passively holding ETH. In the extreme, as the staking ratio approaches 1, real total staking yield only consists of MEV yield.

The shifting composition of the net incentive to stake is a fundamental area of distinction between the two staking ratio regimes. At this point, we want to stress that this composition does not change the effectiveness of the incentive to stake. In other words, dilution protection incentivizes stakers just as much as real staking yields!

What does change though is the desirability of the outcome resulting from that incentive. For low s, staking is a profitable service paid for by the protocol. But for high s, staking loses its profitability and instead becomes an unpleasant necessity to avoid losses from passively holding ETH. Thus, by allowing the staking ratio to “slide to the right”, we risk ending up in the worst of all worlds: Staking becomes a necessary indirection layer, exposing minimal real yield, but threatening dilution for those opting out of accepting LST trust assumptions.

If you give a staker the choice between living in some equilibrium (a) or equilibrium (b) for different issuance policies, this staker, assuming they would stake in both equilibria, would prefer the equilibrium paying higher real staking yield. For obvious reasons a staker cannot “choose” an equilibrium, but the protocol issuance curve effectively determines which equilibrium is reached (given some fixed long term supply curve). Higher issuance is associated with more nominal yield, but importantly, more nominal yield does not imply more real yield.

Solo Staking Viability – down bad

- SSPs with fixed costs naturally benefit from economies of scale, allowing them to operate more profitably (or charge lower fees) as they have more ETH under management. Successful SSPs might be viewed as too-big-to-fail, reducing their perceived tail risks and further contributing to such scale effects. In contrast, solo staking comes with per-staker costs that do not decrease (rather even slightly increasing with networking load!) as the total amount of stake grows. In fact, EIP-7514 was in part merged for this reason.

- As a larger share of issuance goes towards “dilution protection” and no longer contributes to real yield, stakers are left with more and more of their remaining real yield coming from MEV. This yield is by its nature highly variable, which leads to increased volatility of real total yield for solo stakers. For SSPs on the other hand this MEV income is smoothed over all validators they operate, removing staking yield volatility as a concern for them.

- The liquidity gap between solo staking and LSTs widens with increased adoption and moneyness of LSTs. Put differently, the competitive disadvantage of solo staking relative to liquid staking increases as the staking ratio increases.

- In many jurisdictions, the basis for government taxes on staking income is the nominal income, not the real income adjusted for dilution effects. LSTs can be structured in a way to shield holders from this effect, while for solo stakers this is usually not possible. This further increases the profitability gap as the difference between nominal yield and dilution-adjusted real yield widens.

Discussion

The considerations above lead us to argue for the following:

- Holding raw ETH should be economically feasible, to ensure user friendliness and preventing dilution beyond ensuring sufficient security.

- For true economic scalability, Ethereum’s de facto money should be maximally trustless [7].

- An outcome with most of the incentive to stake coming from dilution protection is undesirable for both stakers and ETH holders.

- High staking participation worsens the competitive disadvantage of solo staking.

Ethereum’s future staking ratio is uncertain; however, the absence of control over maximum staking levels warrants a proactive approach in determining optimal levels. Even if high staking ratios may be preferable to some, it should then be a deliberate choice, not an accidental result of exogenous market dynamics.

The following sections are concerned with proposing alternative issuance policies.

Stake Ratio Targeting – endgame staking economics

An endgame staking policy for Ethereum should target a staking ratio, rather than a fixed quantity of staked ETH. This approach ensures accounting for the variable supply of ETH, which changes over time due to EIP-1559 and issuance. In practice, the total supply of ETH currently changes so slowly (-0.3% per year since the merge) that this distinction does not matter in the medium term. However, the intention of an endgame policy is to not require adjustments, even over longer time horizons.

As discussed, while the current issuance curve is designed to ensure a minimum level of staking, it lacks a mechanism to cap staking at an upper bound, potentially resulting in high staking ratios. We argue that a robust endgame issuance policy should express desired staking participation levels by implementing controls on both the lower and upper bounds of staking ratio. Specifically, it should aim to maintain staking ratios within a defined optimal range that reflects the network’s security requirements without enabling negative externalities further.

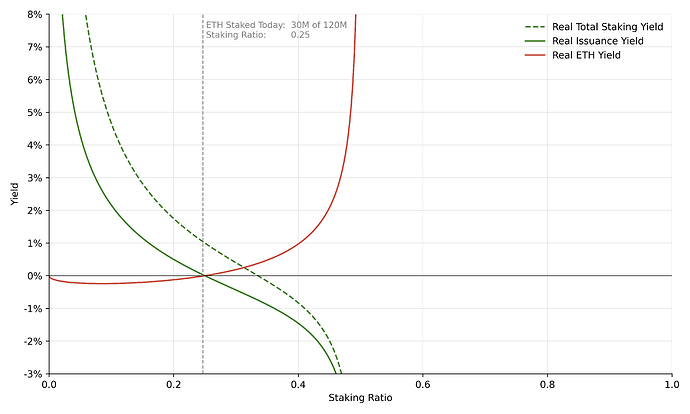

The protocol can express strong opinions for “too-low” and “too-high” staking ratios alike, by issuing very high or low rewards (possibly also negative) respectively. By doing so the protocol regains control over its level of staking participation. To illustrate the existence of a curve with such properties consider the following plot, which is close to Vitalik’s curve here.

In this plot we observe that for low amounts of staking participation the issuance curve rewards generously, similarly to today’s issuance policy. As stake levels increase, issuance yield tapers off and finally turns negative. That way, staking becomes increasingly disincentivized, until it even becomes more profitable to hold ETH than to stake it. In practice, this range of negative total staking yields would not be maintained, with staking participation finding a lower equilibrium. Thus, any curve of such shape would give strong guarantees for the range of viable staking ratios.

Practically it might not be necessary to choose a curve which turns negative so abruptly to achieve similar range targeting properties. In fact, curves that bring issuance rewards down to (or close to) zero beyond some point might even be sufficient for that purpose.

Implications of Targeting

The main advantage of targeting is that it prevents all of the negative aspects of a high staking ratio regime enumerated in the section above. The notable exception to this is the concern around reward variability for solo stakers. Like in the high staking ratio regime, under targeting the share of real yield coming from MEV is also higher than today. A downside of a move to targeting is thus an acceleration of this (already existing) dynamic. However, this increased variance can be mitigated through MEV capture mechanisms such as Execution Tickets or MEV Burn, or instead by introducing a staking fee.

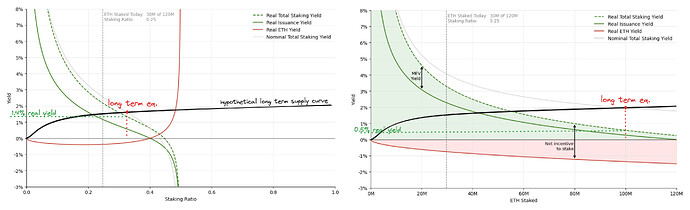

One criticism sometimes brought forward against targeting is that it reduces the overall equilibrium yield, thus worsening the existing competitive pressure between solo staking and SSPs, as well as across different types of SSPs. The idea here is that when there is more money to go around, slightly less competitive forms of staking that might be desirable for the protocol have an easier time staying profitable. To address this concern, the distinction between nominal and real yield is crucial. A move to targeting unquestionably reduces nominal yields when compared to the equilibrium that would otherwise be reached in the long run. However, the same is not generally true about real yield, which is what really matters, as the following sketches illustrate.

The left graph depicts a plausible example for a long term equilibrium under targeting, the right graph similarly an example using today’s issuance curve. Crucially, both examples use the same hypothetical long term supply curve, allowing for a comparison of outcomes. As one can see, the chosen example would in the non-targeting case lead to a high staking participation of around 100M ETH. At that level, most of the staking incentive comes from dilution protection, with a real yield of only around 0.5%. Conversely, under targeting, the same example leads to an equilibrium with lower nominal yield, but little dilution and thus a real yield of around 1.4%.

This example illustrates how targeting can plausibly lead to significantly higher real yield levels than the equivalent outcome under the current system. To the extent that yield levels indeed matter for intensity of competition among different staking types, targeting can thus help prevent a near-zero outcome for real yield. It should be noted here that this is not only beneficial under the aspect of competitive pressure – keeping staking profitable is beneficial for stakers of all types. Moreover, it also benefits non-staking ETH holders, by minimizing the dilution they are exposed to.

Open Questions

This article advocates for the general principle of stake participation targeting. To move to an actual specification that could then be implemented on Ethereum, there are still several open questions that need to be addressed. In closing, we want to briefly touch on each of these questions.

What is the desirable range for stake participation?

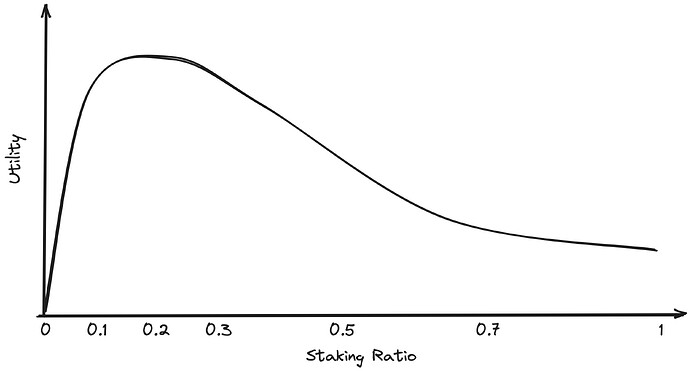

We have deliberately only talked about undesirable ranges, but never specified a precise and desirable range. This is because it is inherently hard to objectively reason about it and needs to be discussed more broadly in the community. The main tradeoff is that little stake participation leaves the protocol open to cheap attacks, while too much staking creates negative externalities as discussed in earlier sections. We once again link to some preliminary discussion on the topic by Vitalik, Vitalik, and Justin. One helpful way to model the decision is by considering the utility of different staking ratios. One possible example for such a utility curve is sketched below.

How to pick a suitable issuance curve, given some target range?

Once a target range is picked, there is still a wide design space of possible issuance curves, that could be chosen to achieve the specified goals. Further work is necessary to compare the possible choices and pick the best candidate. In addition, alternative targeting mechanisms, such as an EIP-1559-like feedback controller, should continue to be explored.

How to ensure incentive compatibility of consensus duties for close-to-zero or negative issuance?

The purpose of issuance is to reward the correct performance of validators fulfilling their consensus duties. However, under a targeting policy it might be possible for issuance yield to approach zero or even turn negative. A validator might still be incentivized to stake with issuance levels approaching zero or less, for the possibility to capture MEV. However, with no issuance it is rational for a validator to not fulfill all consensus duties. This goes to show that for low issuance levels consensus incentives risk breaking down. To mitigate this, the protocol could charge a fee for the right to validate (and again reward correct participation). This reestablishes incentive compatibility. However, this adds protocol and implementation complexity, of which the details need to be figured out.

How to remove the reward volatility introduced by MEV?

As mentioned before, the mitigation of increased reward volatility is important for solo staking viability and can be achieved through MEV capture mechanisms such as Execution Tickets or MEV Burn, or instead by introducing a fee for validators, as per discussion above. While shipping targeting with one of these solutions already in place would be preferable, in principle this is not a strict dependency.

How to set the target in relative (staking ratio) instead of absolute (fixed ETH amount) terms?

A targeting policy could of course also target a fixed amount of ETH, e.g. 30M ETH. But for future-proofing the issuance policy it is preferable to directly target a staking ratio instead, e.g. \frac{1}{4}. For the issuance policy to target some staking ratios the consensus layer needs to be aware of the amount of stake and supply of ETH. The latter is currently not the case, but could be achieved in a simple two-fork process:

- Fork (1): Start tracking supply changes relative to the time of fork (1).

- Fork (2): Add total supply of ETH at time of fork (1). This together with the ongoing tracking of supply changes since fork (1), gives a running total supply of ETH.

How to transition to a targeting mechanism, when starting with stake participation levels beyond the target range?

The simplest way to transition to a targeting policy is to of course start within the target staking range. However, in the likely scenario that the target range will be surpassed before the transition, this would necessitate a decrease in staking participation. Even with a gradual easing into the new curve, this would in practice entail a significant period, during which stakers would be insufficiently compensated, until the excess stake can exit. It remains an open question how to minimize the adverse impacts on stakers of such a transition.

Conclusion

We discussed the current issuance policy, explained negative externalities as we see them, and elaborated what a path forward could look like. In particular, we suggest targeting a range of staking ratios. However, given the open questions, and in particular the lack of a validator fee mechanism and/or in-protocol MEV capture mechanism, moving to a targeting policy will take time. In the meantime we should update the issuance policy, a stepping stone towards targeting. We make a case for a proposal to update the issuance policy in the upcoming network upgrade Electra here.

Footnotes

[1] on aggregate the network operates at ~97% effectiveness

[2] Read more about why issuance yield and MEV yield together form the demand curve in section 2.1 here.

[3] We want to reiterate that issuance yield and MEV yield together form the demand curve. Further, we make the simplifying assumption that MEV remains constant over time. While historically roughly true, this could of course change.

[4] The performance across validators varies, both in terms of earning issuance rewards (consensus duties) and MEV rewards. However, this variability is relatively small and its discussion beyond the scope of this post.

[5] Read this discussion for an analysis of risks for one such onchain SSP.

[6] We analyze these yields in isolation, in particular we do not consider the tx fee burn mechanism (EIP 1559). The underlying analysis would remain unchanged nonetheless, as all yield curves would be shifted up- or downwards by some constant amount, independent of the staking level. We simply wish to reason about an ETH holder’s decision to stake or not to stake and for that only the difference in yields is relevant.

[7] The asset ETH is more trustless than staked ETH for the slashing risk alone and then of course there is a spectrum of trust required across different SSPs.